Home » Posts tagged 'Feature'

Tag Archives: Feature

Salary increment letter

Sub: Increase in emoluments

Mr ABC Talwar is working with XYZ Corporation Limited as General Manager (Finance ) since 19th January, 2011. He has already put in 1 Year and 3 months satisfactorily.

In view of above, it is suggested that we may give increase of Rs. _________ as a personal pay with effect from 1stApril, 2013.

For,

XYZ Corporation Ltd.

PROFESSIONAL EMAIL SENTENCES

Sentences to make your email look professional: “Further to your mail of today, I have a great pleasure to confirm your reservation for the date mentioned below:” “Looking forward to welcome you to__________ hotel, Dubai and assuring you of our best services at all times”. “It is with great pleasure to confirm ……..” “Thank you for your recent enquiry regarding…..” “Below you will find a summary of your request…..” “Your co-operation on the above would be highly appreciated”. “Once again thank you, awaiting to welcome your guest at _________hotel”. “In response to your mail dated…….we are glad to inform you that we have reserved as follows:” “Hope you find this helpful”. “Hope this is clear enough; feel free to start right away. Thank you”. “Thank you for your time & prompt attention”. “Your prompt reply will be solicited”. “Will revert back to you shortly”. “Many thanks again for your time”. “I trust the above resolves your queries. Should you have any further questions, please don’t hesitate to contact me”. “Hope the above helps, email again if you still having any difficulties”. “Thanks! I appreciate your help”. “With regards to our conversation over the phone” Please ignore my previous mail; sorry for the confusion consider the attached as latest” “I would appreciate your immediate attention to this matter” “We regret the in-convenience caused & thank you for your usual co-operation”. “Kindly acknowledge the same” “Appreciate if you could take this on your urgent consideration to check.” . To take some action: “I would appreciate your help in this matter”. “Would you mind checking it out for me? Thanks in advance”. “Can you get back to me once you have time for it?” “I’d love to hear your advice on this”. . Need a response: “I await a response at your earliest convenience”. “Look forward to hearing from you”. “Can you drop me a quick word, so I know you’ve received this?” . Heard nothing & want to chase: “In reference to my mail of________ (month)” “When you get a moment could you drop me a line about my last mail?” “Any updates so far?” “Could you please advice for the below request sent” “Drop me an email when you will have an update on previous mail”. “I am yet to receive an update from your end, requesting you to revert ASAP”.

The Shape Of Your Teeth Can Reveal A Lot About Your Personality. Check Yours!

Ever thought that the shape of your teeth can reveal a lot about your personality? Neither did I but it’s true that the shape of your teeth can reflect your personality! This science is called Morph psychology and it’s used to evaluate and know about a person’s personality by their appearance. The first thing you notice about a person while having a conversation with them is their teeth. If you know what’s the shape of their teeth you can easily find out what kind of a person they are. There is basically four type of teeth shape- Rectangle, Square, Triangular and Oval.

So take a look at the mirror or look closely while conversing with someone and you may know what kind of personality they possess by seeing the shape of their teeth!

1.Rectangular

People with the rectangular shape of their teeth have practical and solution-oriented characteristics. They are very rational with anything and everything is it work or their personal lives. These people are a total control freak and an amazing decision maker and leader. They make a very good planner

and are dynamic, sociable, talk a lot but are very

sharp with their conversations. They can be very imaginative and full of ideas.

These people can be unemotional and a bit irritable sometimes.

2. Square

This teeth shape is easily identified and the most common type. They possess the same characteristics like a square like the sense of control, orderliness, and objectivity. These people have a good control over their emotions and are calm in any situation. They have a strong entrepreneur qualities, are diplomatic and full of ambition. They are very good with their judgments and decision-making as they’re too objective.

At times they can seem to be harsh due to their sense of control and objectivity.

At times they can seem to be harsh due to their sense of control and objectivity.

3. Triangular

The people with this kind of tooth are carefree in their lives and know how to have fun. They’re optimistic and know how to live in the present moments.

They can appear too independent sometimes and their carefree nature can reflect a lack of rootedness.

4. Oval

These people love art. Or you can say they walk artsy, talk artsy and everything they have is artsy. These people possess shy, organized and sensitive characteristics. From their hair to their accessories, they keep it all artistic.

They are a bit melancholic so they carry a burden of a poet.

3 WAYS TO STOP OVERTHINKING

HERE ARE 3 WAYS TO STOP OVERTHINKING:

1. CONNECT WITH NATURE.

If you don’t live or work in nature, than you need this the most. Take time to get out in nature. This could mean going on your lunch break in a nearby park, or going on a vacation to get away. Anything you can do to strengthen your bond with nature will greatly benefit your mind and stop overthinking immediately.

You can focus on the beauty in the trees, a leaf, a waterfall, the sky, mountains, a lake or whatever you gravitate towards. This will immediately stop your mind. When you allow yourself to do this, you will find that you will think more clearly throughout the day.

2. REPEAT PEACEFUL WORDS TO YOURSELF.

Pay attention to your brain at this very moment…what kinds of thoughts do you observe? Most likely, you will notice that the majority of your thoughts center around what you have to do today, or what someone said that made you angry, or even degrading thoughts about yourself. Don’t feel bad, though; with so much negativity around us, maintaining a consistent positive mindset isn’t always easy. However, you can actually counter the negative words and over thinking with the repetition of peaceful words.

Anytime you notice you are overthinking or you feel anxiety or worry coming on, stop those thoughts in their track as soon as you realize it with calming words. Whatever words resonate with you better.

Examples are: Peace. Love. Light. It’s ok. Life is Good. I’m ok.

While this isn’t completely quieting your mind, it does stop overthinking, it will allow your mind to slow down and focus on what really matters in this moment. Words carry a lot of meaning and power, so use them to your advantage whenever you feel stressed out.

3. MEDITATE.

We suggest meditation a whole lot on our website, but for good reason. When you meditate, you stop the flow of overthinking and negative thoughts bombarding your consciousness every second, and instead move into a space where stillness takes precedence.

While you don’t have to turn off your brain to meditate, many people feel that their thoughts slow down incredibly and overthinking stop immediately.

If you try it and find you still cannot stop thinking, try a guided meditation or yoga. These practices bring awareness into the body, and makes it much easier to cope with daily challenges.

SCOPE OF SALES TAX

WHAT IS THE SCOPE OF SALES TAX ?

It is very important question for a person studying SALES TAX ACT 1990, either for practice or for preparation of Examinations. Here we are going to share with you the scope of SALES TAX in Pakistan in nutshell.

Hope it will be helpful for you both in examinations and practice.

Normal rate of sales tax

– Sales tax @ 17% is charged, levied and paid on the value of:

(i) taxable supplies made by a registered person in the course or furtherance of any taxable activity carried on by him; and

(ii) goods imported into Pakistan.

– Where the taxable supplies are made to a person who has not obtained registration number, there shall be charged, levied and paid a further tax at the rate of 2% of the value in addition to the normal rate of 17%.

– However Federal Government may, by notification in the official Gazette specify the taxable supplies in respect of which the further tax shall not be charged, levied and paid.

– SRO 648(1)/2013 dated 9th July, 2013 provides following list of persons on which this further tax @ 1% is not charged, levied or paid on the taxable supplies of:

(i) Electricity energy supplied to domestic and agricultural consumers.

(ii) Natural gas supplied to domestic consumers.

(iii) Motor oil, diesel oil, jet fuel, kerosene oil and fuel oil.

(iv) Goods sold by the retailers to end customers.

(v) Supply of goods directly to end customers including food, beverages, fertilizers and vehicles.

(vi) Items listed in Third Schedule to the Sales Tax Act, 1990.

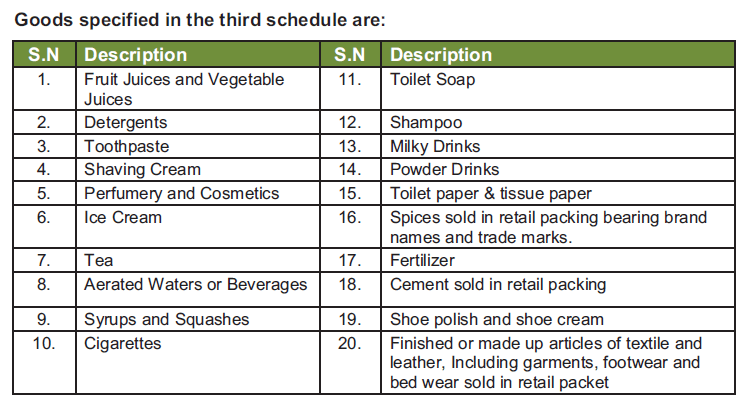

Tax on taxable supplies specified in third schedule [Section 3(2)(a)]

– Sales Tax @17 % will be charged on the retail price on the goods specified in Third Schedule.

– The manufacturer shall legibly, prominently and indelibly print or emboss retail price along with the amount of sales tax on the packet, container, package, cover or label etc.

– Federal Government, may exclude from or include into said schedule any taxable supply by notification in the official Gazette.

Special rates of tax [Section 3(2)(b)]

The Federal Government is empowered to prescribe any higher or lower rate of tax in respect of any class of taxable goods.

Extra tax [Section 3(5)]

Federal Government is empowered to levy and collect tax at such extra rate or amount not exceeding 17% in addition to the amount of sales tax or retail tax, levied under Sales Tax Act, 1990. This tax shall be levied on the value of such goods or class of goods, on such persons or class of persons, in such mode, manner and at time and subject to such conditions & limitations as may be prescribed.

Capacity tax[Section 3(1B)]

Moreover the Board may levy and collect tax on the following instead of levying and collecting tax on taxable supplies:

a. production capacity of plants, machinery, undertaking, establishments or installations producing or manufacturing such goods; or

b. fixed basis, as it may deem fit, from any person who is in a position to collect such tax due to the nature of the business.

Tax on supply to CNG stations

– In case of supply of natural gas to CNG stations, the Gas Transmission and Distribution Company shall charge sales tax from the CNG stations at the rate of 17% on the value of supply to the CNG consumers.

– Value for the purpose of levy of sales tax shall include price of natural gas, charges, rents, commissions and all local, provincial and Federal duties and taxes but excluding the amount of sales tax

Special Powers to the Federal Government

The Federal Government or the Board is authorized to levy, in lieu of Sales Tax under section 3(1), by notification in the Official Gazette such amount of tax as it may deem fit on any supplies or class of supplies or any goods or class of goods. They are also authorized to specify the mode, manner or time of payment of such tax.

All PAC CFAP Mocks Winter 2016 Updated with solutions

Here is the related data for students appearing in ICAP CFAP Examination for Winter 2016.

SALES TAX

SALES TAX INTRODUCTION:

Here I would like to share with you the introduction to the sales tax laws applied in Pakistan.

Sales Tax Laws mainly include:

and some special rules include

Sales Tax Special Procedure Rules, 2007

Sales Tax Special Procedure (Withholding) Rules, 2007

Here are the useful notes on SALES TAX for better understanding of the above mentioned Laws.

TAXATION

Here we share the Video Lectures on Taxation Laws applicable in Pakistan.

Following is the List of Notes and Video Lectures;

1.2 Tax year as defined in ITO 2001

1.4- Scope of Income – Practice Questions

This material is equally useful for the understanding of the general public and more specifically my fellow students of Chartered Accountancy preparing for the following examination of Intermediate Stage CERTIFIED IN ACCOUNTING AND FINANCE (CAF) LEVEL and Final Stage CERTIFIED FINANCE AND ACCOUNTING PROFESSIONAL (CFAP) LEVEL under Institute of Chartered Accountants of Pakistan.

CAF 06 – PRINCIPLES OF TAXATION

CFAP 05 – ADVANCED TAXATION

This will provide basic knowledge in the understanding of objectives of taxation and core areas of Income Tax Ordinance, 2001, Income Tax Rules 2002 and Sales Tax Act 1990 and Sales Tax Rules.

Special Thanks to well known Chartered Accountant honorable Mr. Khalid Petiwal, a well-known Chartered Accountant, for such act of kindness.

Chartered Accountancy in Pakistan

See all you want in the link below:

======================================================================================

ICAP_Catalogue_2014.pdf

==========================================================================

You need further detail and queries contact below: