Home » Tips and Tricks » MS Excel

Category Archives: MS Excel

How to wind up a company?

How to wind up a company? It is a very important question which a professional must know the answer of.

I am sharing here some useful guide for the procedure and legal requirements to wind up a company. I hope that it will be equally useful for the professionals and students of Chartered Accountancy.

The term ‘winding up’ of a company may be defined as the proceedings by which a company is dissolved (i.e. the life of a company is put to an end). Thus, the winding up is the process of putting an end to the life of the company. And during this process, the assets of the company are disposed of, the debts of the company are paid off out of the realized assets or from the contributories and if any surplus is left, it is distributed among the members in proportion to their shareholding in the company. The winding up of the company is also called the ‘liquidation’ of the company. The process of winding up begins after the Court passes the order for winding up or a resolution is passed for voluntary winding up. The company is dissolved after completion of the winding up proceedings. On the dissolution, the company ceases to exist. So, the legal procedure by which the existence of an incorporated company is brought to an end is known as winding up.

Modes of winding up

Modes of winding up

The winding up of a company may be either-

(i) by the Court; or

(ii) voluntary; or

(iii) subject to the supervision of the Court

- PROCEDURE FOR WINDING UP OF COMPANY AND FILING OF PETITION BEFORE RESPECTIVE HIGH COURT:

-

- To pass Special Resolution by 3/4th majority of the members of the company

that the company be wound up by the Court in case if the company itself intend

to file a petition and to file the Special Resolution on Form 26 with the

registrar. - To prepare a list of the assets to ascertain that the company is unable to pay its

debts. - To prepare a list of the creditors

- In case of defaults in payments the creditor or creditors to make a decision for

the filing of the winding up petition. - In case if the Commission or Registrar or a person authorised by the

Commission intend to file a petition, they should not file a petition, for winding

up of the company, unless an investigation into the affairs of the company has

revealed that it was formed for any fraudulent or unlawful purpose or that it is

carrying on a business not authorised by its memorandum or that its business

is

is

being conducted in a manner oppressive to any of its management has been

guilty of fraud, misfeasance or other misconduct towards the company or

towards any of its members. - To engage advocates for the preparation and filing of the petition.

- To pass Special Resolution by 3/4th majority of the members of the company

- PROCEDURE FOR VOLUNTARY WINDING UP

The following steps are to be taken for Member’s voluntary winding up under the Provisions of the Ordinance, and the Companies Rules.

Step 1. Where it is proposed to wind up a company voluntarily, its directors make a declaration of solvency on Form 107 prescribed under Rule 269 of the Rules duly supported by an auditors report and make a decision in their meeting that the proposal to this effect may be submitted to the shareholders. They, then, call a general meeting (Annual or Extra Ordinary) of the members (Section 362 of the Ordinance)

Step 2. The company, on the recommendations of directors, decides that the company be wound up voluntarily and passes a Special Resolution, in general meeting (Annual or Extra Ordinary) appoints a liquidator and fixes his remuneration. On the appointment of liquidator, the Board of directors ceases to exist. (Sections 358 and 364 of the Ordinance)

Step 3. Notice of resolution shall be notified in official Gazette within 10 days and also published in the newspapers simultaneously. A copy of it is to be filed with registrar also. (Section 361 of the Ordinance)

Step 4. Notice of appointment or change of liquidator is to be given to registrar by the company alongwith his consent within 10 days of the event. (Section 366 of the Ordinance)

Step 5. Every liquidator shall, within fourteen days of his appointment, publish in the official Gazette, and deliver to the registrar for registration, a notice of his appointment under section 389 of the Ordinance on Form 110 prescribed under Rule 271 of the Rules.

Step 6. If liquidator feels that full claims of the creditors cannot be met, he must call a meeting of creditors and place before them a statement of assets and liabilities. (Section 368 of the Ordinance)

Step 7. A return of convening the creditors meeting together with the notice of meeting etc. shall be filed by the liquidator with the registrar, within 10 days of the date of meeting. (Section 368 of the Ordinance)

Step 8. If the winding up continues beyond one year, the liquidator should summon a general meeting at the end of each year and make an application to the Court seeking extension of time. (Section 387(5) of the Ordinance)

Step 9. A return of convening of each general meeting together with a copy of the notice, accounts statement and minutes of meeting should be filed with the registrar within 10 days of the date of meeting. (Section 369 of the Ordinance)

Step 10. As soon as affairs of the company are fully wound up, the liquidator shall make a report and account of winding up, call a final meeting of members, notice of convening of final meeting on Form 111 prescribed under Rule 279 of the Rules before which the report / accounts shall be placed. (Section 370 of the Ordinance)

Step 11. A notice of such meeting shall be published in the Gazette and newspapers at least10 days before the date of meeting. (Section 370 of the Ordinance).

Step 12. Within a week after the meeting, the liquidator shall send to the registrar a copy of the report and accounts on Form 112 prescribed under Rule 279 of the Rules. (Section 370 of the Ordinance)

- PROCEDURE FOR CREDITOR’S VOLUNTARY WINDING UP

Step 1. First of all, the company passes a special resolution in the general

meeting of the members of the company for which following steps are to taken:

- Board of Directors approves the agenda of the general meeting especially the draft special resolution for winding up of the company.

·Notice of the general meeting alongwith copy of the draft special resolution is given to the members at least 21 days before the general meeting.

·Special resolution is passed by 3/4th majority of the members of the company and the members appoint a person to be liquidator of the company.

·Special resolution on Form 26 is filed with the registrar.

Step 2 . Meeting of creditors is called at 21 days notice, (simultaneously with sending of the notices of the general meeting of the company) the notice of the meeting of the creditors to be send by post to the creditors, besides, the notice of the said meeting to be advertised in the official Gazette and the newspaper circulated in the Province and the creditors pass a resolution of voluntary winding up of the company. The creditors also appoint liquidator in that meeting. If the creditors and the company nomina te different persons, than person nominated by the creditors shall be liquidator.

Step 3. Notice of the resolution passed at the creditor’s meeting shall be

given by the company to the registrar alongwith consent of the liquidator within ten

days of the passing of the resolution.

The company may either at the meeting at which resolution for voluntary winding

up is passed or at any subsequent meeting may, if they think fit, appoint a committee of inspection consisting of not more than five persons. Provided that the creditors may, if they think fit, resolve that all or any of the person so appointed by the company ought not to be member of the committee of inspection.

Step 4. The liquidator should, with all convenient speed, realise the assets, prepare lists of creditors, admit proof, settle list of contributories, make such calls as may be necessary, etc. accordingly as the nature of the case may require, pay secured creditors, pay the costs including the liquidator’s own remuneration, pay preferential claims, and after meeting all the claims of creditors, and after adjusting all claims and rights, distribute the surplus on pro rata basis.

Step 5. In the event of the winding up continuing for more than one year, the liquidator shall summon a general meeting of the company and a meeting of creditors at the end of the first year from the commencement of the winding up and lay before the meetings an audited account of receipts and payments and acts and dealings and of the conduct of winding up during the preceding year together with a statement in the prescribed form and containing the prescribed particulars with respect to the proceedings and position of liquidation and forward by post to every creditor and contributory a copy of the account and statement together with the auditors’ report and notice of the meeting at least ten days before the meeting required to be held.

Step 6. The liquidator prepares the accounts, gets them audited and also presents a final report to the creditors. The steps at this stage are as under:

·The liquidator prepares a final report and accounts of the winding up, showing how the winding up has been conducted and the property of the company have been disposed of.

·Accounts are duly audited by the auditor appointed for the purpose.

·The notice of meeting is sent by post to each contributory of the company and creditor at least ten days before the meeting. The account with a copy of the auditor’s report is also enclosed with the notice.

·The notice of the meeting specifying the time, place and object of the meeting is published at least ten days before the date of the meeting in the official Gazette and in at least one newspaper.

·Within one week after the meeting, the liquidator is required to send to the registrar a copy of his report and account, and make a return to him of the holding of the meeting alongwith the minutes of the meeting.

·If a quorum is not present at the meeting, the liquidator makes a return stating that the meeting was duly summoned and that no quorum was present thereat. The return is filed with the registrar and considered as presented in the meeting.

·The registrar, on receiving the report, account and the return, is required to register them after their scrutiny.

·On the expiration of three months from the registration of final report, accounts and minutes, the company is deemed to be dissolved

- For more details please see

SECP guide on winding up

MS Office product key

9PXQN-JVDCB-7F4VW-6KVJ2-2DJ8W THD8P-7N47Y-73Y8K-T4YK3-2WFPJ FWVGN-7J3C2-QWW79-FY9KT-Y98CJ YJMG6-DT2V7-3J6D3-KVF2M-PR3R8 3P24Q-RVNMM-VYTK4-8R2W7-BDWCJ KP2N2-4GB7B-XCXY9-QREDJ-33WCJ 2QD4N-RG86W-Y9KR3-C98XK-D9K48 NH7D3-QXMPD-46DM6-M4GX3-G82WW RQ9NM-Q6GRX-4QQ29-D77LY-3GM2J RNWDP-TVWFW-7CYKX-877F4-F6X48 R6TN2-W9PF6-79YD9-VT734-843R8 QPR86-NF2M2-23HJN-TFRHX-DYHF8 QKYQV-36NGX-Y7X88-V3M3B-G2948 Q6NWY-D3BR4-YRHDH-2VKT7-94RPJ PJNQH-HXPGK-VWR96-8896M-PYTJW YNKQH-9KQ4V-HTV6H-DB8W5-K2DR8 YNDM3-JGYFK-WX7F6-KWHK6-QYHF8 YYCQ3-6GB4D-6696Y-3BP63-GF4QP NXG3H-RMGEX-8YDWT-3K6WK-GJGK2 PKQR9-PXNG2-4GGK2-C3K7M-JK8CJ 4JXPB-N9HK4-GQ3G8-GV6HD-KKX7C 42RKN-YXH86-282MH-EG747-3J3VC WF4NK-RVKYM-MG7QJ-BYT9E-2PQVC JND3F-KHYQQ-QMYY4-BW3WP-FX892 QV6W9-3XNKH-8JRCK-RYKKM-DPDR8 NBPPC-GJTD4-B3KQX-F7G9P-PGX48 QNP2R-B9X63-JRH2P-87Y7H-XD7F8 2JDF3-MTNJ9-KVB99-BWODT-9KW8W WRX7N-M98K9-B82K8-KEQ4W-D9K48 MNX3P-M9C2M-XD23P-F2KKT-KTM2J RKJTF-HNYXC-DC9D8-8RQ3G-BPY2J HFYWB-YQN3V-Y9XEV-3TRCC-J43R8TN786-9K9FW-8VR7C-7MH7G-V6DVC GFNRH-4TH9M-XYCQ4-7NGJJ-PKB2J FYG4P-ND86E-JR9RG-8DVDX-HCDR8 FD324-NYKDT-JGC3K-DCHTH-BDWCJ F689N-699KK-P2JMJ-C9QH7-2R3R8 C2CRN-Q8HGX-Q7QKP-974KG-RRGJW

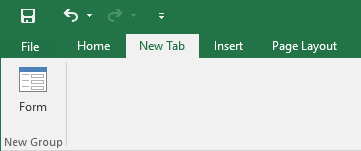

Using a form for data entry in Excel 2016

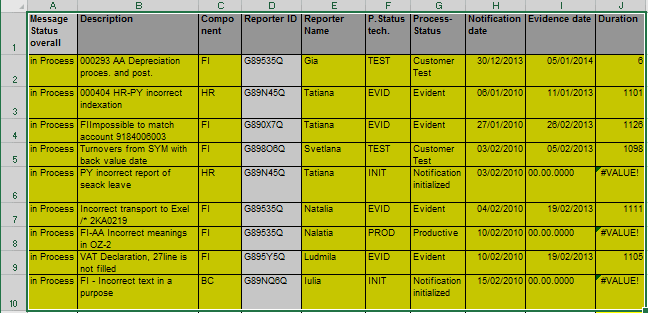

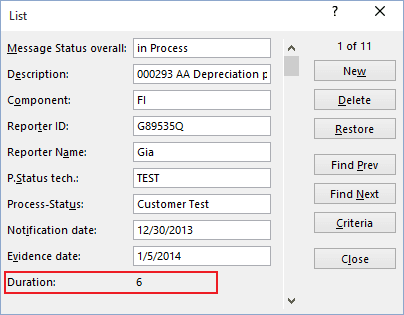

Sometimes you need to manage lists where the information is arranged in rows. Excel offers a simple way to work with this big data in rows.

Unfortunately, the command to access the data form is not on the Ribbon, but you can do one of the following:

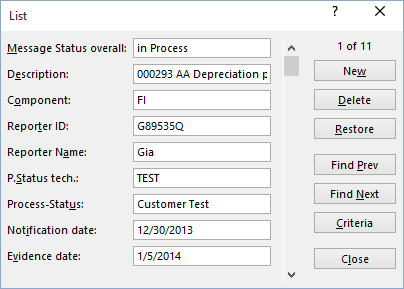

To use the data form, follow these steps:

-

Select data with headers of the columns in the first row of your data range:

-

Click the Form… button on your own menu or in Quick Access toolbar. Excel displays a dialog box customized to your data:

Notes:

-

To move between the text boxes, press Tab.

-

You can’t modify formulas using the data entry form – the formula result appears as text, not as an edit box:

-

To add new row to your table, click New button.

-

You can also use the form to edit the existing data.

Hope it is helpful for You_____________

Contact for any further queries:

MS Excel digits in words of PKR.

Start Microsoft Excel.

Press ALT+F11 to start the Visual Basic Editor.

On the Insert menu, click Module.

Type the following code into the module sheet.

Option Explicit

'Main Function

Function SpellNumber(ByVal MyNumber)

Dim Rupees, Paisas, Temp

Dim DecimalPlace, Count

ReDim Place(9) As String

Place(2) = " Thousand "

Place(3) = " Million "

Place(4) = " Billion "

Place(5) = " Trillion "

' String representation of amount.

MyNumber = Trim(Str(MyNumber))

' Position of decimal place 0 if none.

DecimalPlace = InStr(MyNumber, ".")

' Convert Paisas and set MyNumber to dollar amount.

If DecimalPlace > 0 Then

Paisas = GetTens(Left(Mid(MyNumber, DecimalPlace + 1) & _

"00", 2))

MyNumber = Trim(Left(MyNumber, DecimalPlace - 1))

End If

Count = 1

Do While MyNumber <> ""

Temp = GetHundreds(Right(MyNumber, 3))

If Temp <> "" Then Rupees = Temp & Place(Count) & Rupees

If Len(MyNumber) > 3 Then

MyNumber = Left(MyNumber, Len(MyNumber) - 3)

Else

MyNumber = ""

End If

Count = Count + 1

Loop

Select Case Rupees

Case ""

Rupees = "No Rupees"

Case "One"

Rupees = "One Dollar"

Case Else

Rupees = Rupees & " Rupees"

End Select

Select Case Paisas

Case ""

Paisas = " and No Paisas"

Case "One"

Paisas = " and One Cent"

Case Else

Paisas = " and " & Paisas & " Paisas"

End Select

SpellNumber = Rupees & Paisas

End Function

' Converts a number from 100-999 into text

Function GetHundreds(ByVal MyNumber)

Dim Result As String

If Val(MyNumber) = 0 Then Exit Function

MyNumber = Right("000" & MyNumber, 3)

' Convert the hundreds place.

If Mid(MyNumber, 1, 1) <> "0" Then

Result = GetDigit(Mid(MyNumber, 1, 1)) & " Hundred "

End If

' Convert the tens and ones place.

If Mid(MyNumber, 2, 1) <> "0" Then

Result = Result & GetTens(Mid(MyNumber, 2))

Else

Result = Result & GetDigit(Mid(MyNumber, 3))

End If

GetHundreds = Result

End Function

' Converts a number from 10 to 99 into text.

Function GetTens(TensText)

Dim Result As String

Result = "" ' Null out the temporary function value.

If Val(Left(TensText, 1)) = 1 Then ' If value between 10-19...

Select Case Val(TensText)

Case 10: Result = "Ten"

Case 11: Result = "Eleven"

Case 12: Result = "Twelve"

Case 13: Result = "Thirteen"

Case 14: Result = "Fourteen"

Case 15: Result = "Fifteen"

Case 16: Result = "Sixteen"

Case 17: Result = "Seventeen"

Case 18: Result = "Eighteen"

Case 19: Result = "Nineteen"

Case Else

End Select

Else ' If value between 20-99...

Select Case Val(Left(TensText, 1))

Case 2: Result = "Twenty "

Case 3: Result = "Thirty "

Case 4: Result = "Forty "

Case 5: Result = "Fifty "

Case 6: Result = "Sixty "

Case 7: Result = "Seventy "

Case 8: Result = "Eighty "

Case 9: Result = "Ninety "

Case Else

End Select

Result = Result & GetDigit _

(Right(TensText, 1)) ' Retrieve ones place.

End If

GetTens = Result

End Function

' Converts a number from 1 to 9 into text.

Function GetDigit(Digit)

Select Case Val(Digit)

Case 1: GetDigit = "One"

Case 2: GetDigit = "Two"

Case 3: GetDigit = "Three"

Case 4: GetDigit = "Four"

Case 5: GetDigit = "Five"

Case 6: GetDigit = "Six"

Case 7: GetDigit = "Seven"

Case 8: GetDigit = "Eight"

Case 9: GetDigit = "Nine"

Case Else: GetDigit = ""

End Select

End Function