Home » SALES TAX (Page 3)

Category Archives: SALES TAX

SCOPE OF SALES TAX

WHAT IS THE SCOPE OF SALES TAX ?

It is very important question for a person studying SALES TAX ACT 1990, either for practice or for preparation of Examinations. Here we are going to share with you the scope of SALES TAX in Pakistan in nutshell.

Hope it will be helpful for you both in examinations and practice.

Normal rate of sales tax

– Sales tax @ 17% is charged, levied and paid on the value of:

(i) taxable supplies made by a registered person in the course or furtherance of any taxable activity carried on by him; and

(ii) goods imported into Pakistan.

– Where the taxable supplies are made to a person who has not obtained registration number, there shall be charged, levied and paid a further tax at the rate of 2% of the value in addition to the normal rate of 17%.

– However Federal Government may, by notification in the official Gazette specify the taxable supplies in respect of which the further tax shall not be charged, levied and paid.

– SRO 648(1)/2013 dated 9th July, 2013 provides following list of persons on which this further tax @ 1% is not charged, levied or paid on the taxable supplies of:

(i) Electricity energy supplied to domestic and agricultural consumers.

(ii) Natural gas supplied to domestic consumers.

(iii) Motor oil, diesel oil, jet fuel, kerosene oil and fuel oil.

(iv) Goods sold by the retailers to end customers.

(v) Supply of goods directly to end customers including food, beverages, fertilizers and vehicles.

(vi) Items listed in Third Schedule to the Sales Tax Act, 1990.

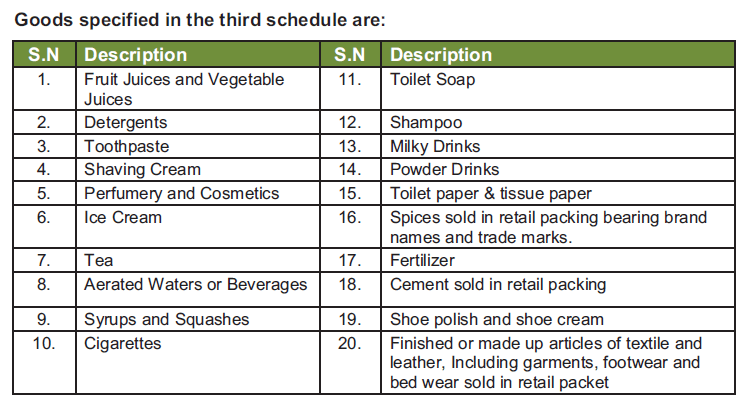

Tax on taxable supplies specified in third schedule [Section 3(2)(a)]

– Sales Tax @17 % will be charged on the retail price on the goods specified in Third Schedule.

– The manufacturer shall legibly, prominently and indelibly print or emboss retail price along with the amount of sales tax on the packet, container, package, cover or label etc.

– Federal Government, may exclude from or include into said schedule any taxable supply by notification in the official Gazette.

Special rates of tax [Section 3(2)(b)]

The Federal Government is empowered to prescribe any higher or lower rate of tax in respect of any class of taxable goods.

Extra tax [Section 3(5)]

Federal Government is empowered to levy and collect tax at such extra rate or amount not exceeding 17% in addition to the amount of sales tax or retail tax, levied under Sales Tax Act, 1990. This tax shall be levied on the value of such goods or class of goods, on such persons or class of persons, in such mode, manner and at time and subject to such conditions & limitations as may be prescribed.

Capacity tax[Section 3(1B)]

Moreover the Board may levy and collect tax on the following instead of levying and collecting tax on taxable supplies:

a. production capacity of plants, machinery, undertaking, establishments or installations producing or manufacturing such goods; or

b. fixed basis, as it may deem fit, from any person who is in a position to collect such tax due to the nature of the business.

Tax on supply to CNG stations

– In case of supply of natural gas to CNG stations, the Gas Transmission and Distribution Company shall charge sales tax from the CNG stations at the rate of 17% on the value of supply to the CNG consumers.

– Value for the purpose of levy of sales tax shall include price of natural gas, charges, rents, commissions and all local, provincial and Federal duties and taxes but excluding the amount of sales tax

Special Powers to the Federal Government

The Federal Government or the Board is authorized to levy, in lieu of Sales Tax under section 3(1), by notification in the Official Gazette such amount of tax as it may deem fit on any supplies or class of supplies or any goods or class of goods. They are also authorized to specify the mode, manner or time of payment of such tax.

All PAC CFAP Mocks Winter 2016 Updated with solutions

Here is the related data for students appearing in ICAP CFAP Examination for Winter 2016.

SALES TAX

SALES TAX INTRODUCTION:

Here I would like to share with you the introduction to the sales tax laws applied in Pakistan.

Sales Tax Laws mainly include:

and some special rules include

Sales Tax Special Procedure Rules, 2007

Sales Tax Special Procedure (Withholding) Rules, 2007

Here are the useful notes on SALES TAX for better understanding of the above mentioned Laws.

Manufacturer-cum-Exporter

Sales Tax Act 1990

Section 2(17)

Manufacturer or producer [Section 2(17)]

Manufacturer means a person who engages, whether exclusively or not, in the production or manufacture of goods whether or not the raw material of which the goods are produced or manufactured are owned by him; and shall include:

⇒ a person who by any process or operation assembles, mixes, cuts, dilutes, bottles, packages, repackages or prepares goods by any other manner;

⇒ an assignee or trustee in bankruptcy, liquidator, executor, or curator or any manufacturer or producer and any person who disposes of his assets in any fiduciary capacity; and

⇒ any person, firm or company which owns, holds, claims or uses any patent, proprietary or other right to goods being manufactured, whether in his or its name, or on his or its behalf, as the case may be, whether or not such person, firm or company sells, distributes, consigns or otherwise disposes of

the goods.

Provided that for the purpose of refund under this Act, only such person shall be

treated as manufacturer-cum-exporter who owns or has his own manufacturing

facility to manufacture or produce the goods exported or to be exported;

Explanation:

The bare reading of the definition clarify that manufacturing services provided by a person on behalf of a principal are covered within the definition of manufacturing. For example dyeing services, toll manufacturing, knitting services etc.

Moreover, any person who either produces goods himself or out-sources

such manufacture is also treated as a manufacturer.

ST 1990, sec 4

Explanation:

Section 4 of the Act elucidates following items which are chargeable to tax at the rate of zero per cent:

- Goods exported, or the goods specified in the Fifth Schedule;

- Supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969 (IV of 1969);

- Such other goods as the Federal Government may, by notification in the Official Gazette, specify provided that nothing in this section shall apply in respect of a supply of goods which –

- are exported, but have been or are intended to be re-imported into

Pakistan; or - have been entered for export under Section 131 of the Customs Act, 1969 (IV of 1969), but are not exported; or

- have been exported to a country specified by the Federal Government,

by Notification in the official Gazette.

Provided further that the Federal Government may by a notification in

the official Gazette, restrict the amount of credit for input tax actually

paid and claimed by a person making a zero-rated supply of goods

otherwise chargeable to sales tax.

- are exported, but have been or are intended to be re-imported into

- Such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of goods at reduced rate of sales tax.

Following is the section 4 of Sales Tax Act 1990:

sec 4. Zero rating.–

Notwithstanding the provisions of section 3, the following goods shall be charged to tax at the rate of zero per cent:-

-(a) goods exported, or the goods specified in the Fifth Schedule;

-(b) supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969 (IV of 1969);

-(c) such other goods as the Federal Government may, by notification in the Gazette, specify:

Provided that nothing in this section shall apply in respect of a supply of goods which

— (i) are exported, but have been or are intended to be re-imported into Pakistan; or

–(ii) have been entered for export under Section 131 of the Customs Act, 1969 (IV of 1969), but are not exported ; or

–(iii) have been exported to a country specified by the Federal Government, by Notification in the official Gazette

Provided further that the Federal Government may by a notification in the official Gazette, restrict the amount of credit for input tax actually paid and claimed by a person making a zero-rated supply of goods otherwise chargeable to sales tax.

-(d) such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of goods supplied at reduced rate of sales tax.

Sales Tax – Definitions

Provisions – under section 2

Here are some most important definitions of Sales Tax Act 1990, to which you have to be familiar with.

01- Tax [Section 2(34)]

“Tax”, unless the context requires otherwise, means sales tax;

02- Sales Tax [Section 2(29A)]

“sales tax” means—

⇒ the tax, additional tax, or default surcharge levied under this Act;

⇒ a fine, penalty or fee imposed or charged under this Act; and

⇒ any other sum payable under the provisions of this Act or the rules made thereunder.

03- Taxable Supplies [Section 2(41)]

“Taxable supply” means a supply of taxable goods made by an importer; manufacturer, wholesaler (including dealer), distributor or retailer other than a supply of goods which is exempt under section 13 and includes a supply of goods chargeable to tax at the rate of zero per cent under section 4.

04- Supply [Section 2(33)]

Supply means “A sale or other transfer of the right to dispose of goods as owner,

including such sale or transfer under a hire purchase agreement and also includes”

⇒ putting to private, business or non-business use of goods produced or manufactured in the course of taxable activity for purposes other than those of making a taxable supply;

⇒ auction or disposal of goods to satisfy a debt owed by a person;

⇒ possession of taxable goods held immediately before a person ceases to be a registered person; and

⇒ in case of manufacture of goods belonging to another person, the transfer or delivery of such goods to the owner or to a person nominated by him:

(Provided that the Federal Government, may by notification in the official Gazette, specify such other transactions which shall or shall not constitute supply.)

05- Taxable Goods [Section 2(39)]

“Taxable goods” means all goods other than those which have been exempted under section 13;

“Goods” include every kind of movable property other than actionable claims, money, stocks, shares and securities;

07- Exempt Supplies [Section 2(11)]

“Exempt supply” means a supply which is exempt from tax under section 13.

[Section 2(11) of the Sales Tax Act, 1990)

08- Zero Rated Supplies [Section 2(48)]

“Zero-rated supply” means a taxable supply which is charged to tax at the rate of zero per cent under section 4.

09- Importer & Manufacturer [Section 2(17)]

Importer [Section 2(13)]

Importer is any person who imports any goods into Pakistan

Manufacturer or producer [Section 2(17)]

Manufacturer means a person who engages, whether exclusively or not, in the production or manufacture of goods whether or not the raw material of which the goods are produced or manufactured are owned by him; and shall include; (more…)

Exempt Supplies, ST 1990, Sec-2(11)

Exempt Supplies, ST 1990, Sec-2(11)

“Exempt supply” means a supply which is exempt from tax under section 13;

EXEMPT SUPPLIES -ST 1990 Sec-13

Section 13 stipulates that following goods are exempt from levy of sales tax:

⇒ Supply or import of goods listed in sixth schedule

⇒ Goods specified by Federal Government through its SROs to the extents and

from the date specified therein

The sixth schedule includes a list of items on which no sales tax is levied.

Following is the excerpts of section 13 of Sales Tax Act 1990;

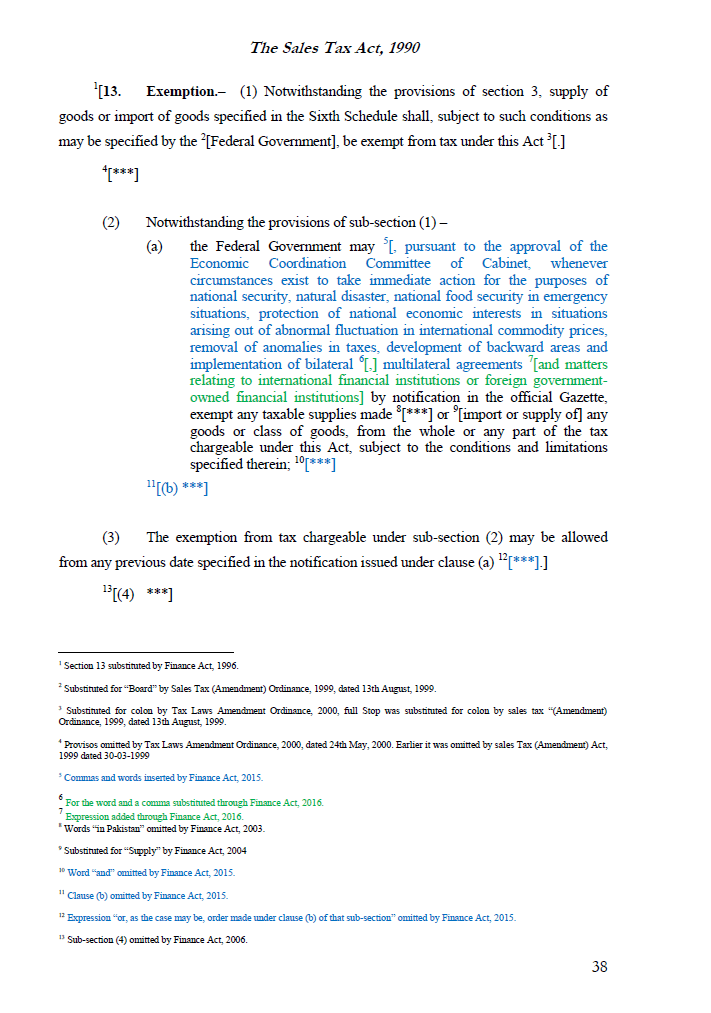

13. Exemption.–

(1) Notwithstanding the provisions of section 3, supply of goods or import of goods specified in the Sixth Schedule shall, subject to such conditions as may be specified by the Federal Government, be exempt from tax under this Act .

(2) Notwithstanding the provisions of sub-section (1) –

(a) the Federal Government may, pursuant to the approval of the Economic Coordination Committee of Cabinet, whenever circumstances exist to take immediate action for the purposes of national security, natural disaster, national food security in emergency situations, protection of national economic interests in situations arising out of abnormal fluctuation in international commodity prices, removal of anomalies in taxes, development of backward areas and implementation of bilateral and multilateral agreements by notification in the official Gazette, exempt any taxable supplies made or import or supply of any goods or class of goods, from the whole or any part of the tax chargeable under this Act, subject to the conditions and limitations specified therein;

(3) The exemption from tax chargeable under sub-section (2) may be allowed from any previous date specified in the notification issued under clause (a).

(4) Sub-section (4) omitted by Finance Act, 2006.

(5) Sub-section (5) omitted by Sales Tax (Amendment) Ordinance, 2000.

(6) The Federal Government shall place before the National Assembly all notifications issued under this section in a financial year.

(7) Any notification issued under sub-section (2), after 1st July, 2015 shall, if not earlier rescinded, stand rescinded on the expiry of the financial year in which it was issued.

Extent and applicability of Sales Tax Act, 1990

LAW – SALES TAX ACT 1990

Provisions – under section 1

Section 1 states that the Sales Tax Act, 1990 extends to the whole of Pakistan.

The territories of Pakistan as per Article 1(2) of the Constitution comprise the

following:

1) the Provinces of Baluchistan, the Khyber Pakhtunkhwa, the Punjab and

Sindh;

2) the Islamabad Capital territory hereinafter referred to as the Federal

Capital;

3) the Federally Administered Tribal Areas; and

4) such States and territories as are or may be included in Pakistan, whether

by accession or otherwise.

It means that the Sales Tax Act, 1990

⇒ is applicable to the whole of Pakistan

except for the tribal areas defined in Article 246 of the Constitution of Pakistan.