Home » SALES TAX (Page 2)

Category Archives: SALES TAX

Notes on TAXATION by Khalid Petiwala for CAF

Notes on TAXATION by Khalid Petiwala for CAF.

Download the valuable notes on TAXATION by Khalid Petiwala.

Notes on Audit CFAP by Khalid Petiwala

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

Advance Audit & Assurance, by Khalid Petiwala with practice questions.

Click here for the Notes.

Khalid Petiwala Notes for CFAP

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

Khalid Petiwala Notes for CAF

Here we are sharing the most valuable exam material source for the CAF students for the following papers of Honorable Mr. Khalid Petiwala:

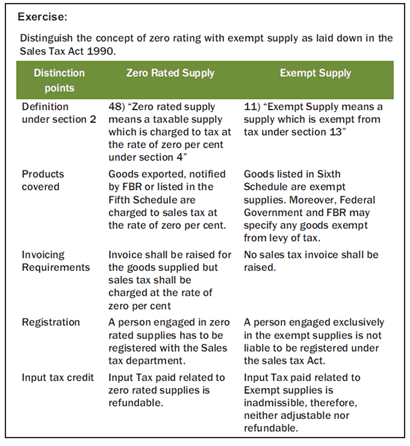

GOODS EXEMPT FROM SALES TAX (SEC-13)

GOODS EXEMPT FROM SALES TAX (SEC-13)

- Supply of goods or import of goods specified in the Sixth Schedule shall, subject to such conditions as may be specified by the Federal Government, be exempt from tax under Sales Tax Act. The provisions of section 13 shall apply notwithstanding anything contained in section 3.

- The Federal Government may, pursuant to the approval of the Economic Coordination Committee of Cabinet exempt any taxable supplies made or import or supply of any goods or class of goods from the whole or any part of the tax chargeable under the Sales Tax Act. This exemption shall be notified in the official Gazette and shall be subject to such conditions and limitations as specified in the notification.

- Exemption from tax chargeable under above second paragraph above may be allowed from any previous date specified in the notification issued or order made.

- The Federal Government shall place before the National Assembly all exemptions related notifications issued during the financial year.

- Any notification issued above, if not earlier recommended stand rescinded on the expiry of financial year in which it has issued.

ZERO RATING AND EXEMPTION

GOODS CHARGED TO TAX @ 0%

_ Value of following goods shall be charged to tax at the rate of zero percent:

- goods exported, or the goods specified in the Fifth Schedule;

- supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969; and

- such other goods notified by the Federal Government in the Official Gazette.

- such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of zerorated goods.

Exception to the above rule

_ Provision relating to zero rating shall not apply in respect of a supply of goods which:

- are exported, but have been or are intended to be re-imported into Pakistan; or

- have been entered for export under Section 131 of the Customs Act, 1969, but are not exported; or

- have been exported to a country specified by the Federal Government, by Notification in the official Gazette.

_ Federal Government may, by a notification in the official Gazette, restrict the amount of credit for input tax actually paid and claimed by a person making a zero-rated supply of goods otherwise chargeable to sales tax.

Fifth Schedule is given hereunder:

| Sr. # | Description |

| 1. | (i) Supply, repair or maintenance of any ship which is neither;

(a) a ship of gross tonnage of less than 15 LDT; nor (b) a ship designed or adapted for use for recreation or pleasure. (ii) Supply, repair or maintenance of any aircraft which is neither (a) an aircraft of weight-less than 8000 kilograms; nor (b) an aircraft designed or adapted for use for recreation or pleasure. (iii) Supply of spare parts and equipment for ships and aircraft falling under (i) and (ii) above. (iv) Supply of equipment and machinery for pilot age, salvage or towage services. (v) Supply of equipment and machinery for air navigation services. (vi) Supply of equipment and machinery for other services provided for the handling of ships or aircraft in a port or Customs Airport. |

| 2. | Supply to diplomats, diplomatic missions, privileged persons and privileged organizations which are covered under various Acts, Orders, Rules, Regulations and Agreements passed by the Parliament or issued or agreed by the Government of Pakistan. |

| 3. | Supplies to duty free shops, provided that in case of clearance from duty free shops against various baggage rules issued under the Customs Act, 1969, (IV of 1969), the supplies from duty free shops shall be treated as import for the purpose of levy of sales

tax. |

| 4. | Supplies of raw materials, components and goods for further manufacture of goods in the Export Processing Zone. |

| 5. |

Supplies of such locally manufactured plant and machinery to petroleum and gas sector Exploration and Production companies, their contractors and sub-contractors as may be specified by the Federal Government, by notification in the official Gazette, subject to such conditions and restrictions as may be specified in such notification. |

| 6. | Supplies of locally manufactured plant and machinery of the

following specifications, to manufacturers in the Export processing zone, subject to the conditions, restriction and procedure given below, namely:- (i) Plant and machinery, operated by power of any description, as is used for the manufacture or production of goods by that manufacture, (ii) Apparatus, appliances and equipments specifically meant or adapted for use in conjunction with the machinery specified in clause (i) ; (iii) Mechanical and electrical control and transmission gear, meant or adopted for use in conjunction with machinery specified in clause (i) ; and (iv) Parts of machinery as specified I clauses (i), (ii) and (iii) identifiable for use in or with such machinery. Conditions, restrictions and procedures:- (a) The supplier of the machinery is registered under the Act: (b) Proper bill of export is filed showing registration number; (c) The purchaser of the machinery is an established manufacturer located in the Export processing zone and holds a certificate from the Export processing zone and holds a certificate from the Export processing zone Authority to that effect; (d) The purchaser submits and indemnity bond in proper form to the satisfaction of the concerned commissioner inland Revenue that the machinery shall, without prior permission from the said commissioner, not be sold, transferred or otherwise moved out of the Export processing zone before a period of five years from the date of entry into the Zone; (e) If the machinery in brought to tariff area of Pakistan, sales tax shall be charged on the value assessed on the bill of entry; and (f) Breach of any of the conditions specified herein shall attract legal action under the relevant provisions of the Act, besides recovery of the amount of sales tax along with default surcharge and penalties involved.”; (g) Against serial number 9, in column (2), the word “who makes local supplies of both taxable and exempt goods” shall be omitted; (h) Against serial number 12, in column (2), in clause (ix), the words “including flavored milk” and the word and figure “and 0402.9900” shall be omitted; and thereafter clauses (x) to (xvi) shall be omitted; |

| 7. | Supplies made To exporters under the Duty and Tax Remission Rules, 2001 subject to the observance of procedures, restrictions and conditions prescribed therein. |

| 8. | Imports or supplies made to Gawadar Special Economic Zone, excluding vehicles falling under heading 87.02 of the Pakistan Customs Tariff, subject to such conditions, limitations and restrictions as the Board may impose. |

| 9. | Petroleum Crude Oil. |

| 10. |

Goods exempted under section 13, if exported by a manufacturer who makes local supplies of both taxable and exempt goods. |

JOINT AND SEVERAL LIABILITY OF REGISTERED PERSONS IN SUPPLY CHAIN WHERE TAX UNPAID (SEC-8B)

JOINT AND SEVERAL LIABILITY OF REGISTERED PERSONS IN SUPPLY CHAIN WHERE TAX UNPAID (SEC-8B)

_ Where a registered person receiving a taxable supply from another registered person is in the knowledge or has reasonable grounds to suspect that some or all of the tax payable in respect of that supply or any previous or subsequent supply of the goods supplied would go unpaid of which burden to prove shall be on the department, such person as well as the person making the taxable supply shall be jointly and severally liable for payment of such unpaid amount of tax.

_ Provided that the Board may by notification in the official gazette, exempt any transaction or transactions from the provisions of this section.

COLLECTION OF EXCESS SALES TAX (SEC-3 B)

COLLECTION OF EXCESS SALES TAX (SEC-3 B)

_ Any person who has collected or collects any tax or charge, whether under misapprehension of any provision of this Act or otherwise, which was not payable as tax or charge or which is in excess of the tax or charge actually payable and the incidence of which has been passed on to the consumer, shall pay the amount of tax or charge so collected to the Federal Government.

_ Any amount payable to the Federal Government shall be deemed to be an arrears of tax or charge payable under this Act and shall be recoverable accordingly and no claim for refund in respect of such amount shall be admissible.

_ The burden of proof that the incidence of tax or charge has been or has not been passed to the consumer shall be on the person collecting the tax or charge.

| Exercise :

Hassan (Pvt.) Ltd. under misapprehension collected additional sales tax of Rs. 100,000 from one of its customers. 65% of the goods on which additional sales tax was collected are still lying with the customer as unsold stock. |

| Answer :

In the above scenario, since 65% of the stock, on which excess tax of (100,000 x 65%) Rs. 65,000 was collected, is still unsold, Hassan Ltd should return this amount to its customer. However, the balance amount of Rs. 35,000, the incidence of which has been passed on to the consumers should be deposited with the Federal Government. |

WHO IS LIABLE TO PAY SALES TAX ?

LIABILITY TO PAY SALES TAX

The liability to pay the tax shall be:

(i) In the case of supply of goods in Pakistan, of the person making the supply, and

(ii) In the case of goods imported into Pakistan, of the person importing the goods.The Federal Government may specify the goods in respect of which the liability to pay tax shall be of the person receiving the supply.