Home » Income Tax (Page 2)

Category Archives: Income Tax

Alternate Corporate Tax (ACT)

Finance Act 2014 introduced new scheme of taxation according to which:

Company shall be required incorporate 17% of its accounting profit being Alternate Corporate Tax (ACT) in to tax computations so as to pay higher of :

- Tax @ 17% of accounting profit

- Actual tax ;or

- Minimum tax on turnover u/s 113 of the Income Tax Ordinance(ITO), 2001.

Accounting profit shall be adjusted for following before applying above mentioned ACT

1.Exempt income under Income Tax Ordinance, 2001.

2.Capital gains on disposal of specified securities

3.Income as a result of import. i.e. Presumptive Tax Regime(PTR) or Final Tax Regime (FTR)

4.Dividends PTR/FTR

5.Supply of goods subject to PTR/FTR

6.Execution of contract subject to PTR/FTR

7.Exports indenting commission subject to PTR/FTR

8.Prizes and winning subject to PTR/FTR

9.Brokerage and Commission subject to PTR/FTR

10.Income subject to tax credit u/s 65D and 65E of the ITO, 2001.

Any excess tax paid over and above actual shall be available for carry forward against tax payable for immediately succeeding 10 tax years.

The carry forward of Alternate Corporate Tax shall not dis-entitle the person to claim carry forward of Minimum tax on the basis of turnover u/s 113 of the ITO, 2001.

The Scheme shall be applicable from the tax year 2014 i.e. Income Tax returns due on 31 December 2014 shall be required to consider Alternate Corporate Tax.

CFAP All Subjects Mocks Winter 2016

Following are the MOCK Exams for Winter – 2016.

3 Adv. Taxation W-2016 Q. Paper.pdf

4 Adv. Taxation W-2016 Solution.pdf

13 Coporate Law Guess – Winter 2016.pdf

14 ITMAC W-2016 (Q. Paper).pdf

15 ITMAC W-2016 (Solution).pdf

17 MAC W-2016 Q.Paper (Final).pdf

For Further Assistance contact us as below.

Notes on Audit CAF by Khalid Petiwala

Here we are sharing the most valuable exam material source for the CAF students for the following papers of Honorable Mr. Khalid Petiwala:

Audit & Assurance, by Khalid Petiwala with practice questions.

Click here for the Notes.

Notes on TAXATION by Khalid Petiwala for CAF

Notes on TAXATION by Khalid Petiwala for CAF.

Download the valuable notes on TAXATION by Khalid Petiwala.

Notes on Audit CFAP by Khalid Petiwala

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

Advance Audit & Assurance, by Khalid Petiwala with practice questions.

Click here for the Notes.

Khalid Petiwala Notes for CFAP

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

All PAC CFAP Mocks Winter 2016 Updated with solutions

Here is the related data for students appearing in ICAP CFAP Examination for Winter 2016.

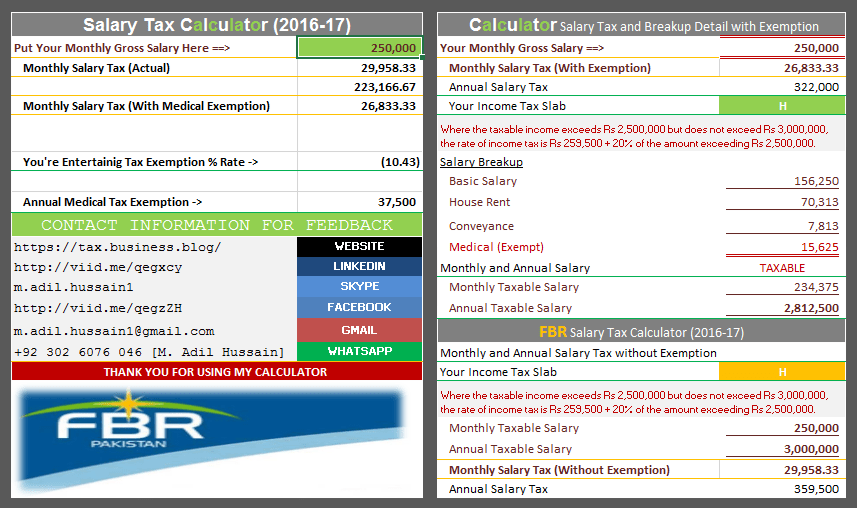

TAXATION

Here we share the Video Lectures on Taxation Laws applicable in Pakistan.

Following is the List of Notes and Video Lectures;

1.2 Tax year as defined in ITO 2001

1.4- Scope of Income – Practice Questions

This material is equally useful for the understanding of the general public and more specifically my fellow students of Chartered Accountancy preparing for the following examination of Intermediate Stage CERTIFIED IN ACCOUNTING AND FINANCE (CAF) LEVEL and Final Stage CERTIFIED FINANCE AND ACCOUNTING PROFESSIONAL (CFAP) LEVEL under Institute of Chartered Accountants of Pakistan.

CAF 06 – PRINCIPLES OF TAXATION

CFAP 05 – ADVANCED TAXATION

This will provide basic knowledge in the understanding of objectives of taxation and core areas of Income Tax Ordinance, 2001, Income Tax Rules 2002 and Sales Tax Act 1990 and Sales Tax Rules.

Special Thanks to well known Chartered Accountant honorable Mr. Khalid Petiwal, a well-known Chartered Accountant, for such act of kindness.