Home » Financial Management

Category Archives: Financial Management

Z Score Model

Altman Z Score Model: Definition

The Altman Z Score model, defined as a financial model to predict the likelihood of bankruptcy in a company, was created by Edward I. Altman. Altman was a professor at the Leonard N. Stern School of Business of New York University. His aim at predicting bankruptcy began around the time of the great depression, in response to a sharp rise in the incidence of default.

Altman Z Score Model: Explanation

To Dr. Altman, z score explained an important issue of the time. For this, he used a weighting system combined with a set of four or five financial ratios to predict a company’s probability of failure. Altman created three different Z Score Models that each serve unique purposes. The original Z Score Model was developed in 1968. It was made from the basis of statistical data from public manufacturing companies and eliminated all companies with assets less than $1 million. However, this original model was not intended for small, non-manufacturing, or private companies. Later, Dr. Altman developed two additional models to the original Z Score Model. In 1983, the Model “A” Z-Score was developed for use with private manufacturing companies. Model “B” was developed for non-public traded general firms and included the service sector. Different models have different variables, weighting and overall predictability scoring systems.

Altman Z Score: Purpose

The purpose of the Z Score Model is to measure a company’s financial health and to predict the probability that a company will collapse within 2 years. It is proven to be very accurate to forecast bankruptcy in a wide variety of contexts and markets. Studies show that the model has 72% – 80% reliability of predicting bankruptcy. However, the Z-Score does not apply to every situation. It can only be used for forecasting if a company being analyzed can be compared to the database.

Altman Z Score: Analysis

In general analysis, the lower the Z-Score, the higher risk of bankruptcy a company has, and vice visa. Different models have different overall predictability scoring. Probabilities of bankruptcy in the above ranges are 95% for one year and 70% within two years.

1. Original Z-Score for public manufacturing companies:

Z-Score Forecast Above 3.0 Bankruptcy is not likely 1.8 to 3.0 Bankruptcy can not be predicted-Gray area Below 1.8 Bankruptcy is likely

2. Model A Z-Score for private manufacturing companies:

Z-Score Forecast Above 2.9 Bankruptcy is not likely 1.23 to 2.9 Bankruptcy can not be predicted-Gray area Below 1.23 Bankruptcy is likely

3. Model B Z-Score for private general companies:

Z-Score Forecast Above 2.60 Bankruptcy is not likely 1.10 to 2.60 Bankruptcy can not be predicted-Gray area Below 1.10 Bankruptcy is likely

Altman Z Score: Formula

1. Original Z-Score formula for public manufacturing companies:

Original Z-Score = 1.2X1 + 1.4X2 + 3.3X3 + 0.6X4 + 0.999X5

2. Model A Z-Score for private manufacturing companies:

This model substitutes the book values of equity for the Market value in X4 compared to original model.

Model A Z-Score = 0.717X1 + 0.847X2 + 3.107X3 +0.420X4 +0.998X5

3. Model B Z-Score for private general companies:

This model analyzed the characteristics and accuracy of a model without X5 – sales/total assets.

Model B Z-Score = 6.56X1 + 3.26X2 +6.72X3 +1.05X4

X1 = working capital/total Assets. It measures the net liquid asset of a company relative to the total assets.

X2 = retained earnings/total Assets. It measures the financial leverage level of a company.

X3 = earnings before interests and taxes/total Assets. It measures productivity of a company’s total assets.

X4 = market value of equity/book value of total liabilities. It measures what portion of a company’s assets can decline in value before the liabilities exceed the assets.

X5 = sales/total Assets. It measures revenue generating ability of a company’s assets.

Altman Z Score: Calculation

If:

Working Capital = $5,000,000

Retained Earnings = $1,000,000

Operating Income = $10,000,000

Market Value of Equity = $2,000,000

Book Value of Total Liabilities = $500,000

Sales = $15,000,000

Total Assets = $3,000,000

Working Capital / Total Assets = $5,000,000 / $3,000,000 = 1.67

Retained Earnings / Total Assets = $1,000,000 / $3,000,000 = .33

Operating Income / Total Assets = $10,000,000 / $3,000,000 = 3.33

Market Value of Equity / Book Value of Total Liabilities = $2,000,000 / $500,000 = 4

Sales / Total Assets = $15,000,000 / $3,000,000 = 5

Model A Z-Score = 0.717X1 + 0.847X2 + 3.107X3 +0.420X4 +0.998X5 = .717(1.67) + .847(.33) + 3.107(3.33) + .420(4) + .998(5) = 18.49321

Altman Z Score: Example

For example, Benny is the CFO of a company which manufactures custom car parts. The company, which started as a local car shop, has evolved into a regional product provider. Benny has been part of the team since he gained his CPA license and has helped the company manage the success it acquired.

With the recent credit market situation, Benny wants to make sure his company will be able to meet the financial obligations it has committed to. Benny decides to calculate for the Altman Z Score; manufacturing has been hit hard enough that he feels he has to. With this decision, he begins assembling company financial reports to find the factors of the Altman Z Score equation as they relate to his company.

Benny performs this calculation:

If:

Working Capital = $5,000,000

Retained Earnings = $1,000,000

Operating Income = $10,000,000

Market Value of Equity = $2,000,000

Book Value of Total Liabilities = $500,000

Sales = $15,000,000

Total Assets = $3,000,000

Working Capital / Total Assets = $5,000,000 / $3,000,000 = 1.67

Retained Earnings / Total Assets = $1,000,000 / $3,000,000 = .33

Operating Income / Total Assets = $10,000,000 / $3,000,000 = 3.33

Market Value of Equity / Book Value of Total Liabilities = $2,000,000 / $500,000 = 4

Sales / Total Assets = $15,000,000 / $3,000,000 = 5

Model A Z-Score = 0.717X1 + 0.847X2 + 3.107X3 +0.420X4 +0.998X5 = .717(1.67) + .847(.33) + 3.107(3.33) + .420(4) + .998(5) = 18.49321

Altman Z Score: Example Conclusion

Benny’s employer has a z score well over 2.9, making bankruptcy very unlikely. This is just as Benny expected. Still, he is happy to do the work. He knows that if he continues to pay attention to the finances of the company he can control them. In this way Benny knows he can direct the finances of the company, turning inefficiency into profit.

Next, Benny does research and finds the Altman Z Score for private companies in his industry. He can use this information to compare his company to common best practices. If he is below the standard, he can find how others have solved the problem. If he is above the standard, he can expand projects which differentiate his company from the average firm.

Benny presents his work in true fashion of Altman; Z-Score tables are made, manufacturing competitive analysis is done, and the project is completed to excellent standards. The effort finally pays off when Benny is offered a bonus of stock options. He feels even closer to the company he has developed his abilities in.

How to wind up a company?

How to wind up a company? It is a very important question which a professional must know the answer of.

I am sharing here some useful guide for the procedure and legal requirements to wind up a company. I hope that it will be equally useful for the professionals and students of Chartered Accountancy.

The term ‘winding up’ of a company may be defined as the proceedings by which a company is dissolved (i.e. the life of a company is put to an end). Thus, the winding up is the process of putting an end to the life of the company. And during this process, the assets of the company are disposed of, the debts of the company are paid off out of the realized assets or from the contributories and if any surplus is left, it is distributed among the members in proportion to their shareholding in the company. The winding up of the company is also called the ‘liquidation’ of the company. The process of winding up begins after the Court passes the order for winding up or a resolution is passed for voluntary winding up. The company is dissolved after completion of the winding up proceedings. On the dissolution, the company ceases to exist. So, the legal procedure by which the existence of an incorporated company is brought to an end is known as winding up.

Modes of winding up

Modes of winding up

The winding up of a company may be either-

(i) by the Court; or

(ii) voluntary; or

(iii) subject to the supervision of the Court

- PROCEDURE FOR WINDING UP OF COMPANY AND FILING OF PETITION BEFORE RESPECTIVE HIGH COURT:

-

- To pass Special Resolution by 3/4th majority of the members of the company

that the company be wound up by the Court in case if the company itself intend

to file a petition and to file the Special Resolution on Form 26 with the

registrar. - To prepare a list of the assets to ascertain that the company is unable to pay its

debts. - To prepare a list of the creditors

- In case of defaults in payments the creditor or creditors to make a decision for

the filing of the winding up petition. - In case if the Commission or Registrar or a person authorised by the

Commission intend to file a petition, they should not file a petition, for winding

up of the company, unless an investigation into the affairs of the company has

revealed that it was formed for any fraudulent or unlawful purpose or that it is

carrying on a business not authorised by its memorandum or that its business

is

is

being conducted in a manner oppressive to any of its management has been

guilty of fraud, misfeasance or other misconduct towards the company or

towards any of its members. - To engage advocates for the preparation and filing of the petition.

- To pass Special Resolution by 3/4th majority of the members of the company

- PROCEDURE FOR VOLUNTARY WINDING UP

The following steps are to be taken for Member’s voluntary winding up under the Provisions of the Ordinance, and the Companies Rules.

Step 1. Where it is proposed to wind up a company voluntarily, its directors make a declaration of solvency on Form 107 prescribed under Rule 269 of the Rules duly supported by an auditors report and make a decision in their meeting that the proposal to this effect may be submitted to the shareholders. They, then, call a general meeting (Annual or Extra Ordinary) of the members (Section 362 of the Ordinance)

Step 2. The company, on the recommendations of directors, decides that the company be wound up voluntarily and passes a Special Resolution, in general meeting (Annual or Extra Ordinary) appoints a liquidator and fixes his remuneration. On the appointment of liquidator, the Board of directors ceases to exist. (Sections 358 and 364 of the Ordinance)

Step 3. Notice of resolution shall be notified in official Gazette within 10 days and also published in the newspapers simultaneously. A copy of it is to be filed with registrar also. (Section 361 of the Ordinance)

Step 4. Notice of appointment or change of liquidator is to be given to registrar by the company alongwith his consent within 10 days of the event. (Section 366 of the Ordinance)

Step 5. Every liquidator shall, within fourteen days of his appointment, publish in the official Gazette, and deliver to the registrar for registration, a notice of his appointment under section 389 of the Ordinance on Form 110 prescribed under Rule 271 of the Rules.

Step 6. If liquidator feels that full claims of the creditors cannot be met, he must call a meeting of creditors and place before them a statement of assets and liabilities. (Section 368 of the Ordinance)

Step 7. A return of convening the creditors meeting together with the notice of meeting etc. shall be filed by the liquidator with the registrar, within 10 days of the date of meeting. (Section 368 of the Ordinance)

Step 8. If the winding up continues beyond one year, the liquidator should summon a general meeting at the end of each year and make an application to the Court seeking extension of time. (Section 387(5) of the Ordinance)

Step 9. A return of convening of each general meeting together with a copy of the notice, accounts statement and minutes of meeting should be filed with the registrar within 10 days of the date of meeting. (Section 369 of the Ordinance)

Step 10. As soon as affairs of the company are fully wound up, the liquidator shall make a report and account of winding up, call a final meeting of members, notice of convening of final meeting on Form 111 prescribed under Rule 279 of the Rules before which the report / accounts shall be placed. (Section 370 of the Ordinance)

Step 11. A notice of such meeting shall be published in the Gazette and newspapers at least10 days before the date of meeting. (Section 370 of the Ordinance).

Step 12. Within a week after the meeting, the liquidator shall send to the registrar a copy of the report and accounts on Form 112 prescribed under Rule 279 of the Rules. (Section 370 of the Ordinance)

- PROCEDURE FOR CREDITOR’S VOLUNTARY WINDING UP

Step 1. First of all, the company passes a special resolution in the general

meeting of the members of the company for which following steps are to taken:

- Board of Directors approves the agenda of the general meeting especially the draft special resolution for winding up of the company.

·Notice of the general meeting alongwith copy of the draft special resolution is given to the members at least 21 days before the general meeting.

·Special resolution is passed by 3/4th majority of the members of the company and the members appoint a person to be liquidator of the company.

·Special resolution on Form 26 is filed with the registrar.

Step 2 . Meeting of creditors is called at 21 days notice, (simultaneously with sending of the notices of the general meeting of the company) the notice of the meeting of the creditors to be send by post to the creditors, besides, the notice of the said meeting to be advertised in the official Gazette and the newspaper circulated in the Province and the creditors pass a resolution of voluntary winding up of the company. The creditors also appoint liquidator in that meeting. If the creditors and the company nomina te different persons, than person nominated by the creditors shall be liquidator.

Step 3. Notice of the resolution passed at the creditor’s meeting shall be

given by the company to the registrar alongwith consent of the liquidator within ten

days of the passing of the resolution.

The company may either at the meeting at which resolution for voluntary winding

up is passed or at any subsequent meeting may, if they think fit, appoint a committee of inspection consisting of not more than five persons. Provided that the creditors may, if they think fit, resolve that all or any of the person so appointed by the company ought not to be member of the committee of inspection.

Step 4. The liquidator should, with all convenient speed, realise the assets, prepare lists of creditors, admit proof, settle list of contributories, make such calls as may be necessary, etc. accordingly as the nature of the case may require, pay secured creditors, pay the costs including the liquidator’s own remuneration, pay preferential claims, and after meeting all the claims of creditors, and after adjusting all claims and rights, distribute the surplus on pro rata basis.

Step 5. In the event of the winding up continuing for more than one year, the liquidator shall summon a general meeting of the company and a meeting of creditors at the end of the first year from the commencement of the winding up and lay before the meetings an audited account of receipts and payments and acts and dealings and of the conduct of winding up during the preceding year together with a statement in the prescribed form and containing the prescribed particulars with respect to the proceedings and position of liquidation and forward by post to every creditor and contributory a copy of the account and statement together with the auditors’ report and notice of the meeting at least ten days before the meeting required to be held.

Step 6. The liquidator prepares the accounts, gets them audited and also presents a final report to the creditors. The steps at this stage are as under:

·The liquidator prepares a final report and accounts of the winding up, showing how the winding up has been conducted and the property of the company have been disposed of.

·Accounts are duly audited by the auditor appointed for the purpose.

·The notice of meeting is sent by post to each contributory of the company and creditor at least ten days before the meeting. The account with a copy of the auditor’s report is also enclosed with the notice.

·The notice of the meeting specifying the time, place and object of the meeting is published at least ten days before the date of the meeting in the official Gazette and in at least one newspaper.

·Within one week after the meeting, the liquidator is required to send to the registrar a copy of his report and account, and make a return to him of the holding of the meeting alongwith the minutes of the meeting.

·If a quorum is not present at the meeting, the liquidator makes a return stating that the meeting was duly summoned and that no quorum was present thereat. The return is filed with the registrar and considered as presented in the meeting.

·The registrar, on receiving the report, account and the return, is required to register them after their scrutiny.

·On the expiration of three months from the registration of final report, accounts and minutes, the company is deemed to be dissolved

- For more details please see

SECP guide on winding up

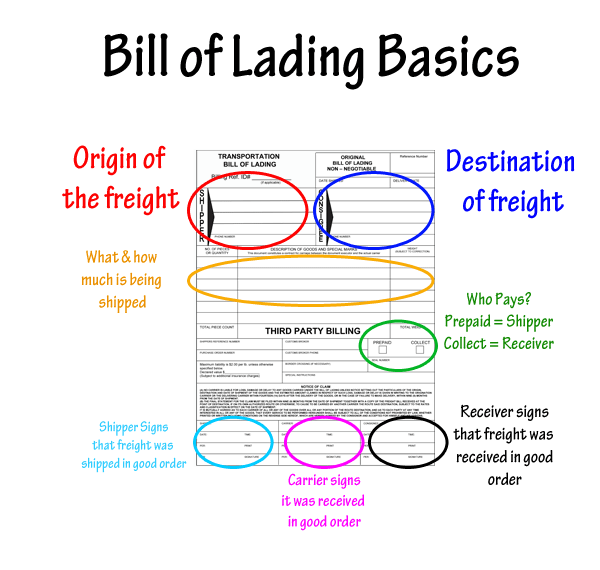

How to differentiate Bill of Lading and Master Bill of Lading?

What is Bill of lading? How Master Bill of Lading differentiate from Bill of Lading.

What is Bill of lading? How Master Bill of Lading differentiate from Bill of Lading.

If you know about bill of lading and master bill of lading, you can differentiate both. Let us discuss what is Bill of lading and how does bill of lading work.

Bill of lading is a document issued by sea carrier of goods on receipt of cargo to him from the shipper (a person or company that transports or receives goods by sea, land, or air.). Bill of lading is issued to shipper after completion of export customs clearance procedures at load port customs location of the country.

After completion of export customs formalities, shipper hands over cargo to sea shipping carrier or his agent. As proof of receipt of goods, sea carrier or his agent issues a document which is called bill of lading (BL). Bill of lading is generally issued in triplicate with non negotiable copies. BL also is issued in quintuplicate (fivefold, multiply by five) on special request by shipper.

Once after obtaining original bill of lading from the sea carrier, shipper submits bill of lading with other documents with his bank, in turn bank sends to importer through importer’s bank. Importer collects bill of lading and other required documents from his bank and arranges for import customs clearance procedures. The shipper can surrender original bill of lading at load port where BL has been released and arranges to send a OBL release message to the counterpart office of sea carrier and advise them to release cargo without insisting for original bill of lading from consignee. The shipper also can release Seaway bill where in no original bill of lading procedures involved.

What is MBL master bill of lading and how does it work?

MBL means Master Bill of Lading issued by vessel owner or his agent to a freight forwarder on receipt of goods from shipper agreeing to deliver goods at destination.

Practical scenario:

A, a freight forwarder acts as a carrier legally accepts cargo from an exporter X agreeing to deliver cargo to Y at New York. A issues bill of lading to X on receipt of goods after necessary export customs formalities. A after receiving goods from X transfers goods to C who is a main carrier of goods. While transferring goods to C, A obtains a bill of lading from main carrier C agreeing to deliver cargo at New York. Here, the bill of lading issued by A to X is called house bill of lading and the bill of lading issued by C to A is called Master Bill of Lading.

Conclusion:

Have you cleared your doubt yourselves about the difference between Bill of Lading and Master Bill of Lading?. Ok, let me conclude below the major differences between BL and MBL:

Bill of lading (BL) is a document, which is a proof of receipt of goods from shipper issued by sea carrier after completing export customs clearance procedures and formalities. If a freight forwarder delivers goods received from final shipper to main sea shipping carriers and obtains document of receipt of goods which is called Master Bill of Lading (MBL). In turn, said freight forwarder issues bill of lading to final shipper which is called House Bill of Lading (HBL).

Remember:

All Master Bills of Lading (HBL) are Bills of Lading, but all Bills of Lading need not be Master Bills of Lading. Correct? ∞

Difference between DA and DP/DAP terms of payment

DA in payment term of international trade means, Documents against Acceptance.

DP in payment term of imports and exports means Documents against Payments.

How to distinguish between Documents against Acceptance and Documents against Payment in Exports and Impor ts?

ts?

Both DA and DP are the terms of payment related to acceptance of shipping documents pertaining to each consignment from buyer’s bank. Under a DA terms of payment, importer accepts documents on the basis of an assurance to effect payment by accepting necessary bill of exchange. The importer collects shipping documents required to take delivery of imported goods from his bank after such assurance on payment at mutually agreed maturity date of payment.

In a DP payment terms, the imported need to effect payment against respective import consignment, before collecting documents for delivery of imported goods. Under a payment terms – Documents against Payments, the bank delivers documents required for import clearance only after receiving the value of goods from the importer. The buyer takes delivery of goods with the original transport document of title delivered by his bank after effecting payment under sale of goods mentioned in the document. The buyer’s bank in turn, sends the said amount to seller’s bank as per banking procedures and formalities under international trade.