NON-FILERS ALLOWED PURCHASE OF IMMOVABLE PROPERTIES, MOTOR VEHICLES

September 18, 2018.

Non-filers of income tax returns have been allowed to purchase immovable properties and motor vehicles as proposed on Tuesday through Finance Bill (Amendment) 2018/2019.

The non-filers were restricted in the budget 2018/2019 to purchase immovable property above Rs5 million and purchase of any engine capacity motor vehicles from Tax Year 2019 and onwards.

Finance Minister Asad Umar on the floor of house presented amendment to Finance Act 2018 and said that complained had been received from overseas Pakistani regarding difficulties in investing in immovable properties and purchase of motor vehicles due to restriction.

The finance minister said that overseas Pakistanis were mainly non-filers and considering the hardship faced by them it was decided to lift the condition.

The previous government through budget 2018/2019 imposed this restriction to increase the number of return filers for documentation of economy.

Your message has been sent

Finance Bill 2018: Immovable property, vehicle purchases only by return filers

The government has introduced major changes through Finance Bill 2018 for broadening the tax base and makes it mandatory purchases of immovable properties and vehicles only by filers of income tax returns.

A fundamental step has been taken in order to curb acquisition of certain assets by persons who are outside the taxation regime.

A new provision in the form of section 227C has been introduced which overrides any other law for the time being in force.

Under this provision, a person who is not a ‘filer’ (a taxpayer whose name does not appear in the active taxpayers’ list issued by the Board or is not holder of a taxpayer‘s card) will not be entitled to processing of any application:

- For booking, registration or purchase of a newly manufactured vehicle or imported vehicle.

- From any authority responsible for registration, recording, attesting immovable property.

This appropriate step which has been undertaken to curb the parking of untaxed money in acquisition of new vehicles and immovable properties need to be examined in the context of Constitutional provisions in relation to the fundamental right in respect of acquisition of assets.

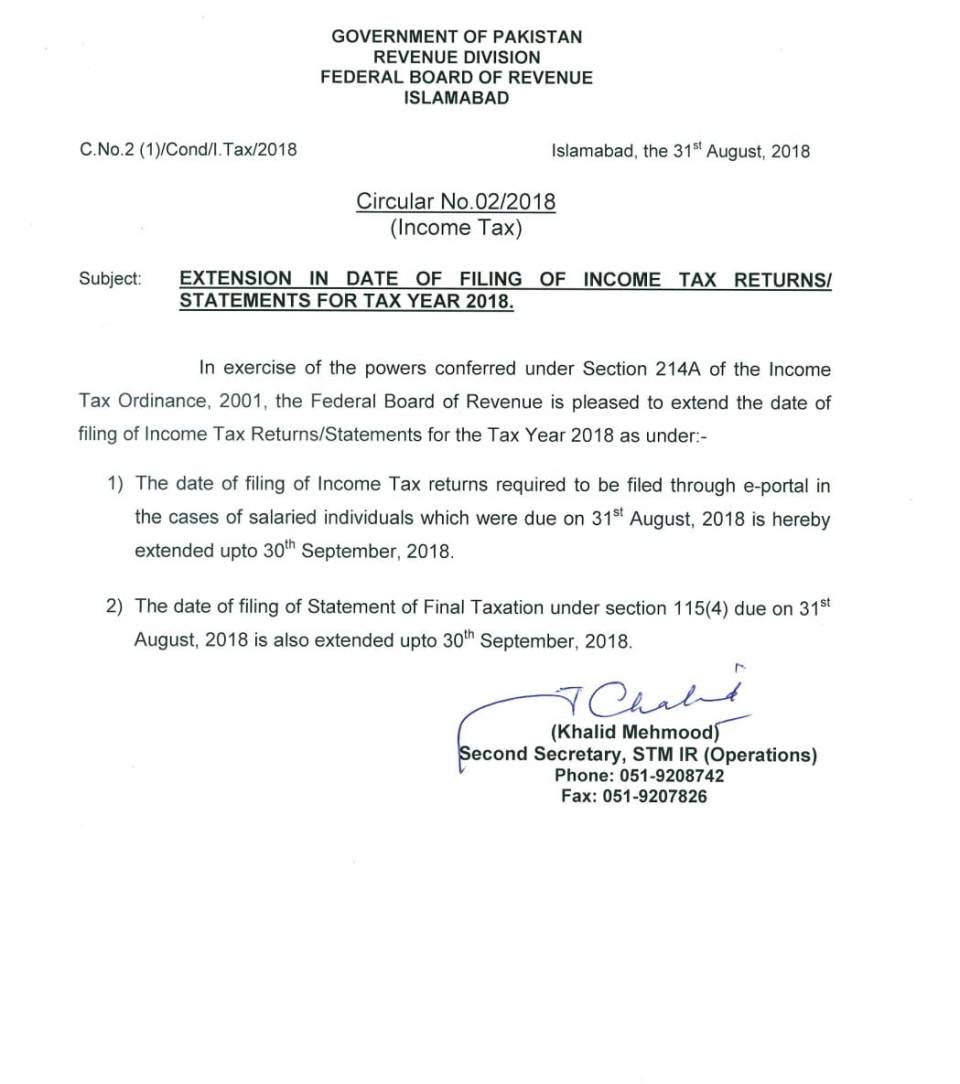

FBR extended the date of filing of Income Tax Return

FBR has extended the date of filing of Income Tax Return for salaried individual and Statement of final taxation u/s 115(4) for Tax Year 2018 up-to September 30, 2018.

Highlights of Finance Bill 2018

It explains following:

1. The Finance Bill 2018 includes certain policy changes in the taxation regime that have been there over three to four decades.

Following revolutionary positive measures have been introduced:

a) Valuation of Immovable Properties and the pre-emptive right of the Government to acquire under-declared properties;

b) Restriction on acquisition of immovable properties and new vehicles by nonfilers;

c) Measures relating to non-cash gifts between persons who are not relatives;

d) Abolition of presumptive tax regime for commercial Importers;

e) Introduction of the concept of year of discovery for taxation of unexplained foreign sourced income and foreign assets;

f) Withdrawal of immunity of foreign remittances exceeding certain threshold; and

g) Substantial reduction in tax rates for Individuals including salaried class.

2. As a result of the reduction in tax rates for businesses undertaken by Individuals, the difference in tax incidence for similar businesses undertaken by corporate sector and Association of Persons (AOP) vis-à-vis an Individual has widened.

The net effective take home income through a corporate business and AOP is limited to Rs 60 if the profit is Rs 100 whereas same business undertaken by an individual will result in take home income of Rs 85.

This difference may lead to de-corporatization of businesses. We propose that the gap should be reduced.

Generally accepted international measure for the same is to treat tax on dividend as adjustable against corporate tax liability so as to avoid economic double taxation.

3. The Government has introduced one time compliance scheme for disclosure of undeclared income and assets. The Finance Bill has proposed certain measures to curb the possibility of future accumulation of undeclared foreign assets and foreign income.

4. In order to incorporate tax measures for proper disclosure of foreign assets and foreign income and enhance the ambit of anti-avoidance provisions, the Finance Bill has introduced certain provisions which may deem a foreign source income as Pakistan source income.

This aspect needs to be examined in relation to the generally accepted principle of international taxation.

5. In order to avoid protracted litigation and delay in settlement of cases, the whole concept of Alternative Dispute Resolution (ADR) has been revamped.

Now, the ADR Committee (ADRC) will comprise of three members, out of which two will be independent persons.

If the taxpayer decides to opt for ADR regime instead of appellate regime then the recommendations of ADRC will be binding on both the parties.

6. In the past, certain anti-corporate tax measures such as levy of tax on bonus shares, tax on undistributed profits and super tax had been introduced.

Through the Finance Bill, corrective actions have been taken in respect of all these measures and tax on bonus shares has been abolished whereas the other two taxes are to be phased out over the period of time.

7. In the past, regressive measures were adopted that had rolled back the business oriented regime for group taxation.

It was expected that certain measures will be introduced to reinstate all-inclusive group taxation system.

No such measures are, however, appearing in the Finance Bill. It is expected that these measures will be taken care of in the Finance Act, 2018.

8. There has been disputes between taxpayers and tax department on the matter of taxability of composite contracts undertaken by non-residents.

These disputes inter alia primarily relate to taxation of offshore supplies being part of an overall arrangement.

The Finance Bill has proposed deeming provisions for taxation of income from such supplies which, in our view, overrides the principles of nexus as laid down in international taxation system.

This matter requires reconsideration to bring it in line with the generally accepted principles especially in the cases where the contracts are executed by a person resident in a tax treaty jurisdictions.

9. Domestic tax laws around the globe invariably provide principles to curb tax avoidance measures, however, details guidelines and processes are laid down for this purpose.

Substantial powers have been provided to taxation authorities for undertaking actions in case of tax avoidance schemes which include disregarding a legal entity and protection provided under the tax treaties.

These provisions without substantive guidelines and safeguards are prone to abuse by the tax authorities.

It is suggested that the application of the same be subject to the adoption of detailed guidelines for General Anti-Avoidance Regulations (GAAR).

10. Banking companies are subject to tax on their profits as determined by the regulations prescribed by State Bank of Pakistan (being the Regulator of Banking Sector in Pakistan).

The application of recharacterisation provisions in the case of banking companies is undesirable where the amount of profit is the one as determined in accordance with SBP regulations.

11. It should be the objective of every growth based taxation policy to encourage capital investment in plant and machinery.

This objective is achieved by allowing charge for depreciation against taxable income and the right to carry forward in subsequent year.

The Finance Bill has proposed certain measures whereby the right to adjust brought forward unabsorbed depreciation is being deferred.

This negates the very objective of the concept as described above which may lead to curtailment of industrial investment without any real benefit to the Government.

12. There has been a general and genuine complaint of taxpayers for repetitive selection for tax audits.

A corrective measure has been proposed whereby a composite audit, covering Income Tax, Sales Tax and Federal Excise, shall be undertaken not more than once in three years.

There are cases of abuse of provisions relating to amendment of assessment in order to create tax demands. Corrective measures are required in this regard also.

Mobile Handset Levy

A new levy on mobile handsets is all set to stir things up come July 1st. It is called the Mobile Handset Levy, and the government is expecting to collect around Rs. 12 billion revenue from it. The levy is fashioned after a similar exercise run in different countries.

It involves matching the IMEI numbers of all legally imported handsets with those that are active on the networks of telecom operators on a daily basis. If an IMEI number is on the network but its record does not exist with the Federal Bureau of Revenue (FBR), an automatic SMS will be sent to that device asking the owner to deposit sales tax, customs duty as well as the handset levy with the tax authorities within 30 days. Failure to comply will result in the device being barred from all Pakistani networks.

The amount of the levy varies, depending on the cost of the device. All devices below Rs 10,000 will be exempt. Those that cost between Rs 10,000 and Rs. 40,000 will charged Rs 1,000 as handset levy while those between Rs 40,000 and 80,000 will be charged Rs 3,000. Finally, the handsets whose cost is above Rs 80,000 will be will be levied a payment of Rs 5,000.

| Cost of the device |

Amount of the levy |

| Below Rs. 10,000 | Exempt |

| From Rs. 10,000 to 40,000 | Rs. 1,000 |

| From Rs. 40,000 to 80,000 | Rs. 3,000 |

| Above Rs. 80,000 | Rs. 5,000 |

Sources in the finance ministry tell Dawn that an exercise is currently underway to enable data sharing between the Pakistan Telecommunications Authority (PTA) and the FBR. All legally imported mobile handsets have their IMEI numbers registered with the customs authorities at the time duties and sales taxes are paid, giving FBR a database of all such handsets. However, the IMEI number of all smuggled handsets doesn’t exists in the FBR database. The new program will compile a daily database of the IMEI numbers of all handsets that are connected to Pakistani networks. Those devices whose IMEI number has no record in the FBR database will automatically be flagged as a smuggled device, and the owner will be required to pay the duties and taxes in addition to the handset levy, to continue using their device.

Sources reveal to Dawn that several meetings to create this number-matching system have already been held, and the PTA is preparing to do a soft launch of the program on May 25, which hopes to iron out all glitches till June 30 after which the system will be launched. To process the payment, the government has built a system that will enable users to pay online or through an ATM machine, the sources add.

Most people do not know whether the device they are using is legally imported, with all duties and sales tax paid, or it is smuggled with tax and duty evaded. According to government figures, around 10 million handsets are imported into the country legally every year and 8.2m have already been imported so far till March 2018. There is no data available on the size of smuggled handsets.

The finance minister says the levy is designed to discourage smuggling of handsets, as well as promoting registration of all IMEI numbers, that can help curb mobile phone theft. “Through this system,” he tells Dawn, “we can ensure that a stolen phone will never be able to connect to a Pakistani network again.” He also hopes it will encourage local assembly of handsets

Source: https://www.dawn.com/news/1404525

sted to abolish the provincial rates for the collection of stamp duty (commonly known as DC rates) and to collect a total of one percent tax under stamp duty and capital value tax on the value declared by the buyer and the seller of property.

sted to abolish the provincial rates for the collection of stamp duty (commonly known as DC rates) and to collect a total of one percent tax under stamp duty and capital value tax on the value declared by the buyer and the seller of property.