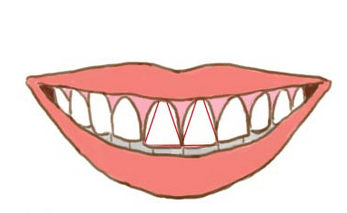

The Shape Of Your Teeth Can Reveal A Lot About Your Personality. Check Yours!

Ever thought that the shape of your teeth can reveal a lot about your personality? Neither did I but it’s true that the shape of your teeth can reflect your personality! This science is called Morph psychology and it’s used to evaluate and know about a person’s personality by their appearance. The first thing you notice about a person while having a conversation with them is their teeth. If you know what’s the shape of their teeth you can easily find out what kind of a person they are. There is basically four type of teeth shape- Rectangle, Square, Triangular and Oval.

So take a look at the mirror or look closely while conversing with someone and you may know what kind of personality they possess by seeing the shape of their teeth!

1.Rectangular

People with the rectangular shape of their teeth have practical and solution-oriented characteristics. They are very rational with anything and everything is it work or their personal lives. These people are a total control freak and an amazing decision maker and leader. They make a very good planner

and are dynamic, sociable, talk a lot but are very

sharp with their conversations. They can be very imaginative and full of ideas.

These people can be unemotional and a bit irritable sometimes.

2. Square

This teeth shape is easily identified and the most common type. They possess the same characteristics like a square like the sense of control, orderliness, and objectivity. These people have a good control over their emotions and are calm in any situation. They have a strong entrepreneur qualities, are diplomatic and full of ambition. They are very good with their judgments and decision-making as they’re too objective.

At times they can seem to be harsh due to their sense of control and objectivity.

At times they can seem to be harsh due to their sense of control and objectivity.

3. Triangular

The people with this kind of tooth are carefree in their lives and know how to have fun. They’re optimistic and know how to live in the present moments.

They can appear too independent sometimes and their carefree nature can reflect a lack of rootedness.

4. Oval

These people love art. Or you can say they walk artsy, talk artsy and everything they have is artsy. These people possess shy, organized and sensitive characteristics. From their hair to their accessories, they keep it all artistic.

They are a bit melancholic so they carry a burden of a poet.

15 Habits of Irresistible People

You know that person who seems to have a flair of good luck? The one who, even though isn’t drop-dead gorgeous, is always able to get whatever she wants? There is more to the outer beauty of these people. They light up a room when they walk into it. This type of person is able to accomplish much in life because of attitude, charisma, or something as simple as kindness. Their smile exudes confidence, compassion and joy. You may wonder what separates them from others.

Dr. Travis Bradberry, author of Emotional Intelligence 2.0, has researched and studied the emotional connection of people. He has recognized that there are basic characteristics that make some people more friendly and charismatic to others.

“When influential people speak, conversations spread like ripples in a pond. And those ripples are multidirectional; influencers inspire everyone around them to explore new ideas and think differently about their work.” Likeable people are conscious of how they treat others. They believe that “Few things kill likeability as quickly as arrogance.” Irresistible people don’t act as if they are better than you. They actually believe that you have the ability to succeed, and create the life that you want. But, what’s the secret to truly being this type of person?

HERE ARE 15 THINGS IRRESISTIBLE PEOPLE DO DIFFERENTLY:

1. THEY TREAT EVERYONE WITH DIGNITY AND RESPECT.

Irresistible people don’t put others down. What makes them so likeable is the ability to treat a homeless person in the same manner that he would treat the CEO to a huge company. To this person, there is no class or status that separates anyone. We are all part of the human race.

2. THEY DON’T GOSSIP.

The charismatic person has no need to utilize gossip as their motive to partake in a conversation. They are always bringing in the best of themselves, and allowing others to shine. This is what makes them so generous in uplifting others. Gossip is a negative trait, and they have little tolerance for it.

3. THEY TREAT OTHERS AS THEY EXPECT TO BE TREATED.

Dr. Bradberry believes that these type of folks follow a healthy life rule that says you should treat others the way you wish to be treated. “But that rule is flawed because it assumes that everyone wants to be treated the same way. In reality, people have different desires and goals.”

The irresistible person understands this and follows not the golden rule, but the platinum one: treat others the way THEY want to be treated.

4. THEY HAVE HEALTHY BOUNDARIES.

Irresistible people don’t try to please everyone all the time. They know that there is a time and place for everything. They don’t give more of themselves. They have healthy ways of assisting and giving to others. But, they never run themselves ragged. These people take care of themselves. And, in that ability to sustain boundaries, they show a beautiful example of self-love to others.

5. THEY ARE GENUINE.

These type of people do not pretend to be someone they are not. What you see is what you get. They exude self-confidence. The irresistible person doesn’t have to have super-model looks, but she or he will walk into a room with such confidence that they shine. They know their worth, and never allow others to dictate how they should see themselves.

6. THEY HAVE INTEGRITY.

Albert Einstein said, “Whoever is careless with the truth in small matters cannot be trusted with important matters.” The person with integrity stands in their authenticity. They know what matters and this is passed on to others. They make you question your honesty, principles, and goodness. Integrity is one of the best characteristics that they teach others.

7. THEY SMILE AT EVERYONE.

The most powerful and attractive quality that an irresistible person has is their ability to always smile, in spite of whatever is going on in their lives. They bring forth laughter with their energy. These likable people know that a smile is sexier than any outfit, stronger than any pill, and has the ability to break down negativity.

8. THEY ARE COMPASSIONATE.

The irresistible person is empathetic to others. They show compassion to animals, nature, and people. They know that one minute you might be on top of the world, and in an instant you can find yourself struggling. Being compassionate is not just about showing kindness to those you like, but also leaving the zone of comfort and stepping into places that the heart breaks into pieces. They take chances in loving others and they know it’s worth it. They help everyone. They wear their hearts in their sleeves.

9. THEY LOVE LIFE.

Successful and charming individuals love life. They are not exempt from heart ache, misfortunes, or challenges, but they know that life is priceless and it’s the only thing that is real. This life is for taking chances, loving, and helping others. They cherish every moment, and when they meet someone new, they make that person feel as if they are the most incredible thing in their day.

10. THEY BRING PEOPLE TOGETHER.

These people are huge human connectors. They bring like-minded people together. They want to help others succeed. If you are among these type of enchanting individuals, you will notice that they immediately display a sense of connection. They may become your own fairy godmother, helping you reach to the next level. They will immediately draw you a map to get to someone who can help you on your journey.

11. THEY TRULY LOVE PEOPLE.

This is a given. These happy people love people. The irresistible person is the one who coined the term “people person.” They love to be around others. They get inspired by energy and stories. The likeable individual has an ability to attract those who are ready to fly and conquer their own dreams.

12. THEY KNOW YOU MUST WORK HARD TO GET AHEAD.

The irresistible person may always wear a smile, but they know that nothing comes without hard work and some struggling. They work hard and succeed with an undeniable thirst for accomplishing their desires. They succeed because they don’t give up. And, when you are among this type of person, you also feel that ability to overcome anything ahead.

13. THEY LISTEN.

Dr. Bradberry says, “People like to know you’re listening, and something as simple as a clarification question shows not only that you are listening but that you also care about what they’re saying. You’ll be surprised how much respect and appreciation you gain just by asking good questions.”

The irresistible person has this innate ability to stare into your spirit and truly make you feel as if you are understood, acknowledged and loved.

14. THEY HAVE POSITIVE ATTITUDES.

In spite of all the challenges in life, these folks continue to have positive attitudes. They don’t feed into negativity. They don’t entertain the woe-is-me attitude from anyone. They avoid confrontations and always search for an optimistic answer to the heavy questions in life.

15. THEY ALWAYS SAY “PLEASE” AND “THANK YOU.”

The ability to show gratitude is a magic wand for the irresistible person. They know that compliments go a long way in the journey of life, but what truly makes others like you are the simple manners: saying “please” and “thank you.” These magic words are never misused, and they know exactly how powerful they are in making others feel understood, acknowledged, and accepted.

Irresistible people are those individuals who have been through emotional roller coasters and major transitional obstacles, and have learned that they aren’t alone in this world. You might just be one of these amazing people. You might be so humble that you don’t recognize how you are changing the world around you. These people know that we have a connection to each other. They make you feel as if you matter. And, that is one of the most profound effects they leave as their legacy: they truly see you, feel you, and care about you. ∞

10 SIGNS YOU’RE DEHYDRATED

Did you know that 25% of kids and teenagers don’t drink ANY water as part of their fluid intake?

A surprising number of adults don’t drink enough water, as well, with one study finding that half of Americans don’t get their recommended daily intake of water. Not drinking enough water can cause serious health problems, including digestive issues, urinary tract infections, anxiety, and chronic fatigue.

Not surprisingly, 75% of Americans suffer from chronic dehydration, according to a report by CBS.

Because water composes about 60% of our bodies, 75% of our muscles, and 85% of our brains, you should take dehydration very seriously. Dehydration can inhibit the function of many parts of the body, leaving you feeling lethargic, sick, and even depressed. However, if you know what to look for, you can stop dehydration before it leads to more serious complications.

HERE ARE 10 SIGNS YOU’RE DEHYDRATED:

1. YOUR MOUTH, SKIN, AND EYES FEEL DRY.

One of the biggest signs you’re dehydrated appears on your skin, believe it or not. If you don’t drink enough water, you won’t sweat out all the internal and external toxins in your body, which means you will be prone to clogged pores, resulting in breakouts.

Also, if you have trouble producing tears, a lack of water could be the culprit. Obviously, having a dry mouth signals to your brain that you need more water, also. Water does so much for our bodies, and in general, that parched feeling you get in your mouth can be felt in other areas of the body, too.

2. YOU USE THE BATHROOM INFREQUENTLY, AND WHEN YOU DO, YOUR URINE IS DARK YELLOW OR BROWN.

This is a big red flag that you’re dehydrated. Many people don’t eliminate waste enough times throughout the day, which means the toxins just accumulate inside their bodies. Water helps flush out these toxins, not to mention, keep your renal system running smoothly. If you make trips to the bathroom only a couple times a day, you should really consider drinking more water.

Also, the color of your urine will paint the true picture of how much water you’re consuming. If your urine isn’t clear at the end of the day, make sure to drink a glass or two of water before bed. Yellow or brown urine is a big sign that you’re dehydrated, and means that your body is retaining fluids in order to maintain vital bodily functions.

3. YOUR BACK AND JOINTS HURT OFTEN.

Since your body’s cartilage is composed of nearly 80% water, replenishing water after sweating is essential for keeping bones and joints healthy. Water keeps joints lubricated in order to protect the body during strenuous activities or unexpected movement, such as falling or tripping. In addition, back pain could indicate a kidney infection due to being dehydrated, so if you have frequent back aches, drink more water throughout the day.

4. YOU FEEL EXHAUSTED AND HAVE WILD MOOD SWINGS.

Water brings oxygen into the body. The more oxygenated your cells, the more alive you will feel. However, if you don’t drink enough water, the body must get oxygen from your blood to compensate, which will suck your body of oxygen. This will make your whole system slow down, and make it harder for your body to function properly. This will inevitably make you more tired, moody, and downright lethargic.

5. YOU’RE RAVENOUSLY HUNGRY, EVEN IF YOU’VE JUST EATEN.

This might seem confusing, since hunger pangs usually indicate that you need to eat. However, it can also mean that you’re dehydrated. Dehydration tricks the body into thinking it needs to eat, when really, you just need water. Hunger and thirst cues come from the same part of the brain, which could explain this confusion. Try drinking a glass of water the next time you feel hungry, and if the pain goes away, that means you were just dehydrated. If it persists, it probably means you need to eat something, as well.

6. YOU HAVE HIGH BLOOD PRESSURE.

Dehydration causes the blood to become thicker, resulting in slower blood flow and a higher sodium content in the blood. All of these factors combined provide the perfect environment and conditions for high blood pressure, which can result in some of the other health problems on this list.

7. YOU HAVE HIGH CHOLESTEROL.

Being dehydrated means that your body will hold onto any water it can find so more water loss doesn’t occur. In this study, 15 people completed a fast under two different circumstances: once without fluid replacement, and another time with salt and water supplementation. The researchers found that when the participants fasted with no fluids, their total serum cholesterol levels were much higher than when they were provided with salt and fluid supplementation. While most people still drink water during a fast, drinking sugary, nutrient-lacking drinks in place of water throughout the day can cause dehydration, and therefore, higher cholesterol levels.

8. YOU HAVE TROUBLE DIGESTING FOOD.

Water gets things moving throughout your entire body, including your digestive system. Water serves as a wonderful way to cleanse and detoxify the body, but without enough water, waste moves through the colon much more slowly, which can lead to constipation or other digestive disorders. Water helps to get things moving in the digestive system, but when the body is in a dehydrated state, the large intestine soaks up the water from the foods you eat. This increases the likelihood of constipation, acid reflux, ulcers, and other digestive issues.

9. YOU HAVE FREQUENT RASHES ON YOUR SKIN.

The effects of dehydration normally appear on the outside of our bodies, because water detoxifies and hydrates every part of the body, including the skin. Without adequate water, toxins build up on our skin, resulting in many different skin disorders. Acne, psoriasis, eczema, and discoloration can all occur as a result of dehydration.

10. YOU HAVE MIGRAINES AND CAN’T THINK CLEARLY.

Dehydration actually causes our brain tissue to lose water, resulting in the brain shrinking and pulling away from the skull. In turn, this sends alarms to the pain receptors surrounding the brain, which gives you that nasty midday headache. Being dehydrated decreases blood volume, which means less blood and oxygen will flow to the brain. The blood vessels in the brain dilate to keep the blood flowing, resulting in inflammation and a pounding headache that many people are unfortunately all too familiar with.

Alternative Corporate Tax

Introduction to ACT :

– A new section 113C titled as “Alternative Corporate Tax” has been introduced through Finance Act, 2014, which starts with a “non-obstante clause” i.e. Notwithstanding anything contained in this Ordinance (Income Tax Ordinance, 2001)

– Applicable for tax year 2014 and onwards

– Tax payable by a “Company” will be higher of the “Corporate Tax” (generally includes minimum and final taxes apart from certain exceptions) or “Alternative Corporate Tax” (17% of Accounting Income subject to certain adjustments and exclusions)

– Rationale for introduction of ACT was explained in the “Salient features” of Budget documents “to discourage perpetual declaration of losses or very low income using tax avoidance means by Companies”.

– The Finance Minister in his Budget Speech also mentioned that “ACT is being introduced for corporate cases where taxable income is usually far less than accounting income due to careful tax planning to avail all possible avenues of tax avoidance technically.”

International Examples :

– India

18.5% of book profits of the Company (termed as adjusted accounting profits).

– Argentina

Applicable at 1% of the value of fixed and current assets.

– Mexico

17.5% of Flat Tax Base computed on the basis of certain cash inflows and outflows

– Austria

Minimum amounts of tax have been prescribed for certain types of companies.

– Mauritius

7.5% of book profits or 10% of dividends, whichever is higher.

Except for Mauritius, in all the above cases, adjustment is allowed for next 10 years.

Effect of non-obstante clause :

– The provisions of section 113C only have an overriding effect over other provisions of the Income Tax Ordinance, 2001

– In case of any conflict between the provisions of section 113C and any other provision of the Income Tax Ordinance, 2001, the provisions of section 113C will prevail

– If, however, there is a conflict between section 113C and any other provision of a Special Statute, the provisions of section 113C will remain subservient to the provisions of such Special Statute. Much would, however, depend upon the language of such Special Statute and the nature of conflict.

– The provisions of section 113C are in the nature of “Self Contained code”. Other provisions of the Income Tax Ordinance cannot be applied automatically except to the extent permitted by Section 113C itself.

Effective year & retrospective application :

– Specifically mentioned to be applicable for tax year 2014 and onwards.

– Not a one-time levy but also intended to be applicable for subsequent tax years.

– Companies following Special Tax Years already ended before introduction of section 113C are affected by this levy.

– Even for Companies following June 30 as their year-end are also affected by this law as all advance tax payments were already made in accordance with normal provisions.

– ACT, thus, has a retrospective effect for tax year 2014 by way of expressed language and not by way of any intendment.

– Constitutional validity of the retrospective application is to be decided by the Courts. It is, however, generally believed that a retrospective law is valid if made through expressed legislation.

Taxpayers covered by ACT :

– ACT is only applicable on a “Company” and as such, all other categories of taxpayers, such as Individuals and Association of Persons are not covered.

– Unlike section 113, ACT is also applicable on non-resident companies.

– Section 113C itself does not define the term “Company” and, therefore, the term has to be construed as per section 80 to include the following.

(a) Locally incorporated Companies, body corporates, Small Companies

(b) Modarabas

(c) Foreign companies

(d) Co-operative societies, Finance societies and other societies

(e) Non-profit organisations

(f) Trust, an entity or body of persons established or constituted by any law

(g) Foreign associations declared by FBR as a Companies

(h) Provincial Governments

(i) Local Governments in Pakistan

Companies not covered by ACT :

– ACT is specified to be non applicable on Taxpayers chargeable to tax in accordance with the following provisions of Income Tax Ordinance, 2001

(a) Fourth Schedule (Insurance Companies)

(b) Fifth Schedule (Mining Companies)

(c) Seventh Schedule (Banking Companies)

– By implication, ACT is also not applicable on following companies:

(i) Companies setting up an Industrial Undertaking between July 1, 2014 to June 30, 2017 and subject to certain conditions, eligible for a reduced tax rate of 20% for a period of five years

(ii) Non-profit organisations and certain trusts and welfare institutions eligible for 100% tax credit under section 100C

(iii) Companies eligible for 100% tax credit under section 65D not having any other income

(iv) Companies not deriving any income other than exempt or certain incomes subject to final taxation or Capital Gains under section 37A

(v) Non-resident companies not having any presence in Pakistan

Computation of ACT :

– ACT is defined as the tax at a rate of 17% of a sum equal to “Accounting Income” as reduced by certain specific adjustments.

– “Accounting Income” is defined as the accounting profit before tax for the tax year, as disclosed in the financial statements, excluding share from the associate recognised under equity method of accounting.

– Following amounts are also excluded from accounting income for computing ACT.

(a) exempt income

(b) income subject to tax under section 37A (capital gains on securities)

(c) income subject to final taxation under section 148(7) – Imports, Section 150 (Dividends), Section 153(3) – Resident Suppliers and Contractors, Section 154 (Exports), Section 156 (Prizes & winnings) and section 233 (3) – Brokerage and Commission

(d) income subject to tax credit under sections 65D and 65E (equity investment in certain Industrial Undertakings)

(e) income subject to tax credit under section 100C (NPOs and certain trusts & welfare institutions); and

(f) income of the Company subject to reduced rate of tax under newly inserted clause 18A of Part II of the Second Schedule

– The sum equal to accounting income less any amount to be excluded therefrom (as mentioned in (a) to (f) above) is to be treated as “Taxable income” for the purposes of section 113C.

– For the purposes of determining the “Accounting Income”, expenses are required to be apportioned between the “excluded amounts” and the balance accounting income (being treated as “taxable income”). FBR’s Circular suggests the apportionment on turnover basis.

– The Commissioner is empowered to make adjustments and proceed to compute accounting income as per historical accounting pattern after providing an opportunity of being heard.

– Tax credit under section 65B (on investment in BMR Plant & Machinery) is allowed against ACT.

Corporate Tax :

Defined as total tax payable by the Company, including-

- tax payable on account of minimum tax (e.g. Minimum tax on turnover under section 113, Minimum tax on builders under section 113A, Minimum tax on land developers under section 113B, minimum tax under section 148(8) on importers of edible oil and packing material, minimum tax under clauses 56B, to 56G for certain persons opting to be taxed under normal tax regime)

- final taxes payable under any provision of the Ordinance but not including those mentioned in Section 8 (FTS and royalty of non-resident persons not having Permanent Establishments in Pakistan, incomes of non-resident shipping & airlines, dividend income)

Following taxes are excluded:

– Section 161 (tax recovered from payer due to default in withholding tax compliance)

– Section 162 (tax recovered from the recipient due to withholding tax non- compliance of payer)

– Default Surcharge or penalty

– ACT payable under section 113C

Carry forward of ACT :

– The excess of Alternative Corporate Tax paid over the Corporate Tax payable for the tax year is to be carried forward and adjusted against the tax payable under Division II of Part I of the First Schedule for following year.

– If the excess tax is not wholly adjusted the unadjusted amount is to be carried forward to the following tax year and so on, however, the excess cannot be carried forward to more than ten tax years immediately succeeding the tax year for which the excess was first computed.

– The entitlement to carry forward minimum tax under section 113 will remain unaffected by ACT.

– If Corporate Tax or ACT is enhanced or reduced as a result of any amendment or as a result of any order, the excess amount to be carried forward will be adjusted accordingly.

FBR’s computational examples :

Example 1 – Explanation of carried forward minimum tax & ACT

Example 1 – Explanation of carried forward minimum tax & ACT

| Corporate Tax (excluding minimum tax) | (A) Rs 100 |

| Minimum tax under section 113 | (B) Rs 140 |

| ACT | (C) Rs 200 |

| Corporate Tax under section 113C | (D=A+B) Rs 140 |

| Excess amount of ACT over Corporate Tax carried forward for next ten tax years | (C-D) 60 |

| Excess amount of Minimum tax carried forward for next five years | (B-A) 40 |

– Discriminatory to Corporate Sector which is documented and subject to Corporate Regulatory requirements whereas other taxpayers such as sole proprietors and AOPs are not subject to ACT regime. The possibility of extending ACT to other taxpayers cannot be ruled out.

– The provision penalises the so-called low tax / no tax paying companies by ignoring the overall contribution to the economic development and omitting to take into account the effect of contribution to the Exchequer by way of other indirect taxes, such as Sales Tax, Provincial Sales Tax, FED and Customs Duty, etc.

– The rationale for 17% of accounting profit is not known and there is no surety if the rate of ACT will remain static in future years depending upon the revenue pressures.

– Arbitrary powers of the Commissioner to determine the accounting profit especially with regard to the unclear terms “historical accounting pattern” and “profit before tax for the tax year as disclosed in the financial

statements.”

PwC 18

– Lack of clarity on the basis of computing excluded items such as exempt income.

– No rationale for apportionment of all expenses especially when there are identifiable direct expenses and the Company is liable to WWF and WPPF.

– Treatment of non-taxable items (such as capital receipts / gain on sale of immovable property held for more than 2 years / 25% of capital gains on long term assets).

– No tax credit other than section 65B will be allowed against ACT, such as Charitable donations (under section 61), sales to registered persons (section 65A) and enlistment (65C).

– Likely to have an impact for small companies entitled to be taxed at a reduced rate of 25% under normal basis.

PwC 19

– Companies having brought forward tax losses and unabsorbed depreciation may also be affected by ACT, which is only applicable on accounting profit for the tax year without any impact of brought forward losses and unabsorbed depreciation

– Following classes of income and persons (otherwise covered by FTR) have not been

excluded from Accounting Income:

(a) Import of ships by ship breakers

(b) Non-resident contractors opting for taxation under FTR

(c) Commission / discount of petrol pump operators

(d) Income of a CNG station

(e) Shipping business qualifying for reduced rate on tonnage basis as final tax

(f) Income from services rendered and construction contracts outside Pakistan subject to tax at 1% of gross receipts

– Adjustment of ACT against taxes payable under the above categories is not provided

PwC 20

– No consequential amendment has been made in section 147 thereby creating an ambiguity as regards the payment of ACT by way of advance tax

– Likely mismatch between the income taxable under FTR (generally on receipt basis)

with the corresponding amounts disclosed in financial statements (on accrual basis)

– Application of ACT on companies opted for group taxation as single fiscal unit

– Treatment of remittance of after tax profits by branches of non-resident companies deemed as dividend requires clarity as the same does not form part of accounting income before tax

3 WAYS TO STOP OVERTHINKING

HERE ARE 3 WAYS TO STOP OVERTHINKING:

1. CONNECT WITH NATURE.

If you don’t live or work in nature, than you need this the most. Take time to get out in nature. This could mean going on your lunch break in a nearby park, or going on a vacation to get away. Anything you can do to strengthen your bond with nature will greatly benefit your mind and stop overthinking immediately.

You can focus on the beauty in the trees, a leaf, a waterfall, the sky, mountains, a lake or whatever you gravitate towards. This will immediately stop your mind. When you allow yourself to do this, you will find that you will think more clearly throughout the day.

2. REPEAT PEACEFUL WORDS TO YOURSELF.

Pay attention to your brain at this very moment…what kinds of thoughts do you observe? Most likely, you will notice that the majority of your thoughts center around what you have to do today, or what someone said that made you angry, or even degrading thoughts about yourself. Don’t feel bad, though; with so much negativity around us, maintaining a consistent positive mindset isn’t always easy. However, you can actually counter the negative words and over thinking with the repetition of peaceful words.

Anytime you notice you are overthinking or you feel anxiety or worry coming on, stop those thoughts in their track as soon as you realize it with calming words. Whatever words resonate with you better.

Examples are: Peace. Love. Light. It’s ok. Life is Good. I’m ok.

While this isn’t completely quieting your mind, it does stop overthinking, it will allow your mind to slow down and focus on what really matters in this moment. Words carry a lot of meaning and power, so use them to your advantage whenever you feel stressed out.

3. MEDITATE.

We suggest meditation a whole lot on our website, but for good reason. When you meditate, you stop the flow of overthinking and negative thoughts bombarding your consciousness every second, and instead move into a space where stillness takes precedence.

While you don’t have to turn off your brain to meditate, many people feel that their thoughts slow down incredibly and overthinking stop immediately.

If you try it and find you still cannot stop thinking, try a guided meditation or yoga. These practices bring awareness into the body, and makes it much easier to cope with daily challenges.

11 QUOTES TO REMEMBER WHEN YOU’RE OVERTHINKING

- You will never be free until you free yourself from the prison of your own false thoughts.

- Before you talk, listen. Before you react, think. Before you criticize, wait. Before you pray, forgive. Before you quit, try!

- Stop worrying about what can go wrong, and get excited about what can go right.

- Overthinking – the art of creating problems that weren’t even there.

- There is nothing in this world that can trouble you as much as your own thoughts.

- Worrying is like sitting in a rocking chair. It gives you something to do but it doesn’t get you anywhere.

- Stop overthinking. You can’t control everything, just let it be.

- Dear mind, please stop thinking so much at night. I need sleep.

- Overthinking is the biggest cause of unhappiness.

- Don’t ruin a new day by thinking about yesterday. Let it go.

- A quiet mind is able to hear intuition over fear.

HERE ARE 3 WAYS TO STOP OVERTHINKING:

1. CONNECT WITH NATURE.

If you don’t live or work in nature, than you need this the most. Take time to get out in nature. This could mean going on your lunch break in a nearby park, or going on a vacation to get away. Anything you can do to strengthen your bond with nature will greatly benefit your mind and stop overthinking immediately.

You can focus on the beauty in the trees, a leaf, a waterfall, the sky, mountains, a lake or whatever you gravitate towards. This will immediately stop your mind. When you allow yourself to do this, you will find that you will think more clearly throughout the day.

2. REPEAT PEACEFUL WORDS TO YOURSELF.

Pay attention to your brain at this very moment…what kinds of thoughts do you observe? Most likely, you will notice that the majority of your thoughts center around what you have to do today, or what someone said that made you angry, or even degrading thoughts about yourself. Don’t feel bad, though; with so much negativity around us, maintaining a consistent positive mindset isn’t always easy. However, you can actually counter the negative words and over thinking with the repetition of peaceful words.

Anytime you notice you are overthinking or you feel anxiety or worry coming on, stop those thoughts in their track as soon as you realize it with calming words. Whatever words resonate with you better.

Examples are: Peace. Love. Light. It’s ok. Life is Good. I’m ok.

While this isn’t completely quieting your mind, it does stop overthinking, it will allow your mind to slow down and focus on what really matters in this moment. Words carry a lot of meaning and power, so use them to your advantage whenever you feel stressed out.

3. MEDITATE.

We suggest meditation a whole lot on our website, but for good reason. When you meditate, you stop the flow of overthinking and negative thoughts bombarding your consciousness every second, and instead move into a space where stillness takes precedence.

While you don’t have to turn off your brain to meditate, many people feel that their thoughts slow down incredibly and overthinking stop immediately.

If you try it and find you still cannot stop thinking, try a guided meditation or yoga. These practices bring awareness into the body, and makes it much easier to cope with daily challenges. ∞