Home » 2016 (Page 4)

Yearly Archives: 2016

ST 1990, sec 4

Explanation:

Section 4 of the Act elucidates following items which are chargeable to tax at the rate of zero per cent:

- Goods exported, or the goods specified in the Fifth Schedule;

- Supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969 (IV of 1969);

- Such other goods as the Federal Government may, by notification in the Official Gazette, specify provided that nothing in this section shall apply in respect of a supply of goods which –

- are exported, but have been or are intended to be re-imported into

Pakistan; or - have been entered for export under Section 131 of the Customs Act, 1969 (IV of 1969), but are not exported; or

- have been exported to a country specified by the Federal Government,

by Notification in the official Gazette.

Provided further that the Federal Government may by a notification in

the official Gazette, restrict the amount of credit for input tax actually

paid and claimed by a person making a zero-rated supply of goods

otherwise chargeable to sales tax.

- are exported, but have been or are intended to be re-imported into

- Such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of goods at reduced rate of sales tax.

Following is the section 4 of Sales Tax Act 1990:

sec 4. Zero rating.–

Notwithstanding the provisions of section 3, the following goods shall be charged to tax at the rate of zero per cent:-

-(a) goods exported, or the goods specified in the Fifth Schedule;

-(b) supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969 (IV of 1969);

-(c) such other goods as the Federal Government may, by notification in the Gazette, specify:

Provided that nothing in this section shall apply in respect of a supply of goods which

— (i) are exported, but have been or are intended to be re-imported into Pakistan; or

–(ii) have been entered for export under Section 131 of the Customs Act, 1969 (IV of 1969), but are not exported ; or

–(iii) have been exported to a country specified by the Federal Government, by Notification in the official Gazette

Provided further that the Federal Government may by a notification in the official Gazette, restrict the amount of credit for input tax actually paid and claimed by a person making a zero-rated supply of goods otherwise chargeable to sales tax.

-(d) such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of goods supplied at reduced rate of sales tax.

Sales Tax – Definitions

Provisions – under section 2

Here are some most important definitions of Sales Tax Act 1990, to which you have to be familiar with.

01- Tax [Section 2(34)]

“Tax”, unless the context requires otherwise, means sales tax;

02- Sales Tax [Section 2(29A)]

“sales tax” means—

⇒ the tax, additional tax, or default surcharge levied under this Act;

⇒ a fine, penalty or fee imposed or charged under this Act; and

⇒ any other sum payable under the provisions of this Act or the rules made thereunder.

03- Taxable Supplies [Section 2(41)]

“Taxable supply” means a supply of taxable goods made by an importer; manufacturer, wholesaler (including dealer), distributor or retailer other than a supply of goods which is exempt under section 13 and includes a supply of goods chargeable to tax at the rate of zero per cent under section 4.

04- Supply [Section 2(33)]

Supply means “A sale or other transfer of the right to dispose of goods as owner,

including such sale or transfer under a hire purchase agreement and also includes”

⇒ putting to private, business or non-business use of goods produced or manufactured in the course of taxable activity for purposes other than those of making a taxable supply;

⇒ auction or disposal of goods to satisfy a debt owed by a person;

⇒ possession of taxable goods held immediately before a person ceases to be a registered person; and

⇒ in case of manufacture of goods belonging to another person, the transfer or delivery of such goods to the owner or to a person nominated by him:

(Provided that the Federal Government, may by notification in the official Gazette, specify such other transactions which shall or shall not constitute supply.)

05- Taxable Goods [Section 2(39)]

“Taxable goods” means all goods other than those which have been exempted under section 13;

“Goods” include every kind of movable property other than actionable claims, money, stocks, shares and securities;

07- Exempt Supplies [Section 2(11)]

“Exempt supply” means a supply which is exempt from tax under section 13.

[Section 2(11) of the Sales Tax Act, 1990)

08- Zero Rated Supplies [Section 2(48)]

“Zero-rated supply” means a taxable supply which is charged to tax at the rate of zero per cent under section 4.

09- Importer & Manufacturer [Section 2(17)]

Importer [Section 2(13)]

Importer is any person who imports any goods into Pakistan

Manufacturer or producer [Section 2(17)]

Manufacturer means a person who engages, whether exclusively or not, in the production or manufacture of goods whether or not the raw material of which the goods are produced or manufactured are owned by him; and shall include; (more…)

Exempt Supplies, ST 1990, Sec-2(11)

Exempt Supplies, ST 1990, Sec-2(11)

“Exempt supply” means a supply which is exempt from tax under section 13;

EXEMPT SUPPLIES -ST 1990 Sec-13

Section 13 stipulates that following goods are exempt from levy of sales tax:

⇒ Supply or import of goods listed in sixth schedule

⇒ Goods specified by Federal Government through its SROs to the extents and

from the date specified therein

The sixth schedule includes a list of items on which no sales tax is levied.

Following is the excerpts of section 13 of Sales Tax Act 1990;

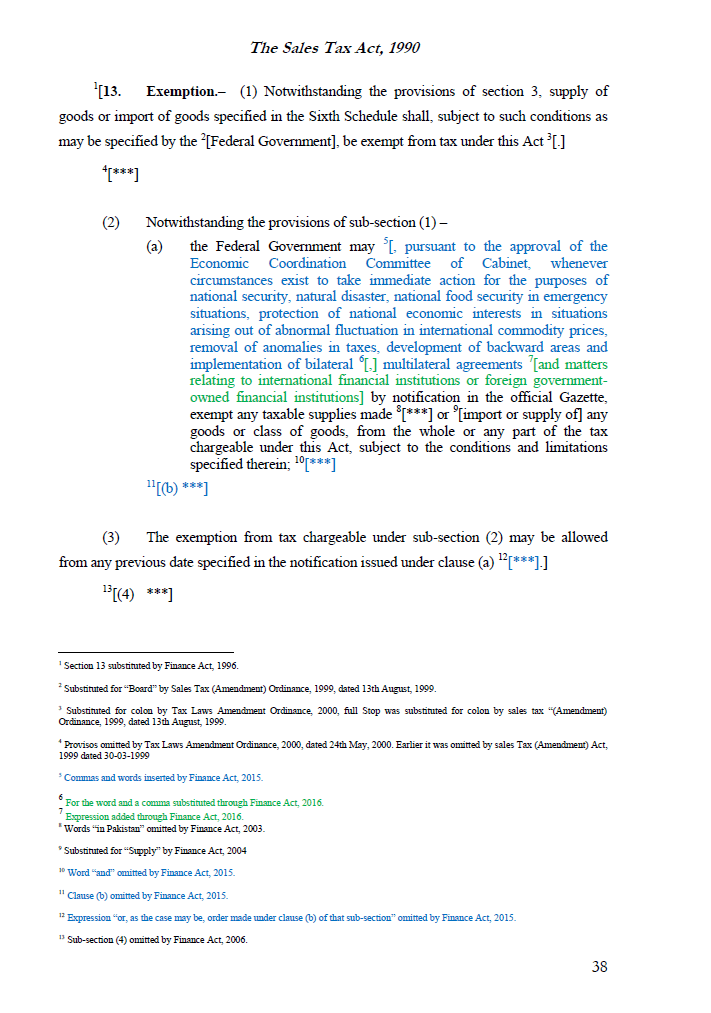

13. Exemption.–

(1) Notwithstanding the provisions of section 3, supply of goods or import of goods specified in the Sixth Schedule shall, subject to such conditions as may be specified by the Federal Government, be exempt from tax under this Act .

(2) Notwithstanding the provisions of sub-section (1) –

(a) the Federal Government may, pursuant to the approval of the Economic Coordination Committee of Cabinet, whenever circumstances exist to take immediate action for the purposes of national security, natural disaster, national food security in emergency situations, protection of national economic interests in situations arising out of abnormal fluctuation in international commodity prices, removal of anomalies in taxes, development of backward areas and implementation of bilateral and multilateral agreements by notification in the official Gazette, exempt any taxable supplies made or import or supply of any goods or class of goods, from the whole or any part of the tax chargeable under this Act, subject to the conditions and limitations specified therein;

(3) The exemption from tax chargeable under sub-section (2) may be allowed from any previous date specified in the notification issued under clause (a).

(4) Sub-section (4) omitted by Finance Act, 2006.

(5) Sub-section (5) omitted by Sales Tax (Amendment) Ordinance, 2000.

(6) The Federal Government shall place before the National Assembly all notifications issued under this section in a financial year.

(7) Any notification issued under sub-section (2), after 1st July, 2015 shall, if not earlier rescinded, stand rescinded on the expiry of the financial year in which it was issued.

Extent and applicability of Sales Tax Act, 1990

LAW – SALES TAX ACT 1990

Provisions – under section 1

Section 1 states that the Sales Tax Act, 1990 extends to the whole of Pakistan.

The territories of Pakistan as per Article 1(2) of the Constitution comprise the

following:

1) the Provinces of Baluchistan, the Khyber Pakhtunkhwa, the Punjab and

Sindh;

2) the Islamabad Capital territory hereinafter referred to as the Federal

Capital;

3) the Federally Administered Tribal Areas; and

4) such States and territories as are or may be included in Pakistan, whether

by accession or otherwise.

It means that the Sales Tax Act, 1990

⇒ is applicable to the whole of Pakistan

except for the tribal areas defined in Article 246 of the Constitution of Pakistan.

SALES TAX INTRODUCTION

SALES TAX INTRODUCTION:

Here I would like to share with you the introduction to the sales tax laws applied in Pakistan.

Sales Tax Laws mainly include:

and some special rules include

Sales Tax Special Procedure Rules, 2007

Sales Tax Special Procedure (Withholding) Rules, 2007

Here are the useful notes on SALES TAX for better understanding of the above mentioned Laws.

PREAMBLE OF SALES TAX ACT 1990

01 -Preamble of SALES TAX ACT 1990

The preamble of Sales tax Act, 1990 states that it is an act to consolidate and

amend the law relating to the levy of a tax on the sale, importation, exportation,

production, manufacture or consumption of goods.

Therefore, tax under the provisions of SALES TAX ACT 1990 is leviable on;

i) the sale of goods

ii) import,

iii) export,

iv) production,

v) manufacture and

vi) consumption of goods.

Scope of Income – Practice Questions

INCOME TAX ORDINANCE 2001

Chapter 01

Practice Questions

Topic – Practice Questions

Click here for Complete Video Lecture Practice Questions .

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Includes:

01- Practice Questions as per the ICAP past papers equally usefull for the CAF06 and CFAP 05 Students, under the provisions of Income Tax Laws of Pakistan i.e. Income Tax Ordinance 2001.

02- Types of Tax years.

03- Taxability of various tax years.

04- Change in tax year

05- Procedure of change in Tax year.

06- Understanding the the Tax treatment of person with respect to Tax Year required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Video Lecture by:

Scope of Income

INCOME TAX ORDINANCE 2001

Chapter 01

Lecture 03

Topic – Scope of Income

Click here for Complete Video Lecture Scope of Income .

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Includes:

01- Scope of Income with respect to taxability under the provisions of Income Tax Laws enacted in Pakistan i.e. Income Tax Ordinance 2001.

02- Taxability of resident person and non-resident person

03- Geographical sources of Incomeand their taxability

04-Taxability of returning expetriate

05- Foreign source salary

06- Exeptions for foreign source salary

07- Understanding the Tax treatment of person with respect to Tax Year required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Lecture by: