REGISTERED PERSON IN SALES TAX

Registered person [section 2(25)]

[―registered person‖ means a person who is registered or is liable to be registered under this Act:

Provided that a person liable to be registered but not registered under this Act shall not be entitled to any benefit available to a registered person under any of the provisions of this Act or the rules made thereunder;]

Therefore;

- A person liable to be registered but not registered is also liable to pay sales tax on goods supplied during the period that he remained unregistered;

- Such person is not entitled to get the benefit of input tax credit or other benefits available to a registered person

Person [section 2(21)]

[(21) ―person‖ means, –

- an individual;

- a company or association of persons incorporated, formed, organized or established in Pakistan or elsewhere;

- the Federal Government;

- a Provincial Government;

- a local authority in Pakistan; or

- a foreign government, a political subdivision of a foreign government, or public international organization;]

CFAP All Subjects Mocks Winter 2016

Following are the MOCK Exams for Winter – 2016.

3 Adv. Taxation W-2016 Q. Paper.pdf

4 Adv. Taxation W-2016 Solution.pdf

13 Coporate Law Guess – Winter 2016.pdf

14 ITMAC W-2016 (Q. Paper).pdf

15 ITMAC W-2016 (Solution).pdf

17 MAC W-2016 Q.Paper (Final).pdf

For Further Assistance contact us as below.

Your message has been sent

Notes on Audit CAF by Khalid Petiwala

Here we are sharing the most valuable exam material source for the CAF students for the following papers of Honorable Mr. Khalid Petiwala:

Audit & Assurance, by Khalid Petiwala with practice questions.

Click here for the Notes.

Notes on TAXATION by Khalid Petiwala for CAF

Notes on TAXATION by Khalid Petiwala for CAF.

Download the valuable notes on TAXATION by Khalid Petiwala.

Notes on Audit CFAP by Khalid Petiwala

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

Advance Audit & Assurance, by Khalid Petiwala with practice questions.

Click here for the Notes.

Khalid Petiwala Notes for CFAP

Here we are sharing the most valuable exam material source for the CFAP students for the following papers of Honorable Mr. Khalid Petiwala:

Khalid Petiwala Notes for CAF

Here we are sharing the most valuable exam material source for the CAF students for the following papers of Honorable Mr. Khalid Petiwala:

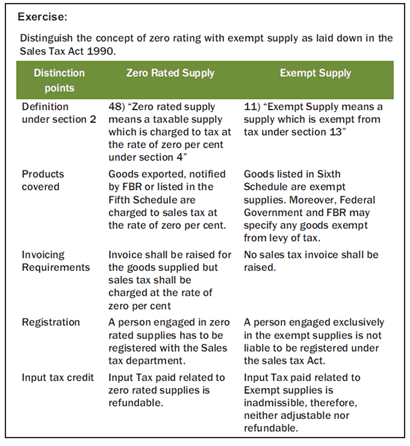

GOODS EXEMPT FROM SALES TAX (SEC-13)

GOODS EXEMPT FROM SALES TAX (SEC-13)

- Supply of goods or import of goods specified in the Sixth Schedule shall, subject to such conditions as may be specified by the Federal Government, be exempt from tax under Sales Tax Act. The provisions of section 13 shall apply notwithstanding anything contained in section 3.

- The Federal Government may, pursuant to the approval of the Economic Coordination Committee of Cabinet exempt any taxable supplies made or import or supply of any goods or class of goods from the whole or any part of the tax chargeable under the Sales Tax Act. This exemption shall be notified in the official Gazette and shall be subject to such conditions and limitations as specified in the notification.

- Exemption from tax chargeable under above second paragraph above may be allowed from any previous date specified in the notification issued or order made.

- The Federal Government shall place before the National Assembly all exemptions related notifications issued during the financial year.

- Any notification issued above, if not earlier recommended stand rescinded on the expiry of financial year in which it has issued.

ZERO RATING AND EXEMPTION

GOODS CHARGED TO TAX @ 0%

_ Value of following goods shall be charged to tax at the rate of zero percent:

- goods exported, or the goods specified in the Fifth Schedule;

- supply of stores and provisions for consumption aboard a conveyance proceeding to a destination outside Pakistan as specified in section 24 of the Customs Act, 1969; and

- such other goods notified by the Federal Government in the Official Gazette.

- such other goods as may be specified by the Federal Board of Revenue through a general order as are supplied to a registered person or class of registered persons engaged in the manufacture and supply of zerorated goods.

Exception to the above rule

_ Provision relating to zero rating shall not apply in respect of a supply of goods which:

- are exported, but have been or are intended to be re-imported into Pakistan; or

- have been entered for export under Section 131 of the Customs Act, 1969, but are not exported; or

- have been exported to a country specified by the Federal Government, by Notification in the official Gazette.

_ Federal Government may, by a notification in the official Gazette, restrict the amount of credit for input tax actually paid and claimed by a person making a zero-rated supply of goods otherwise chargeable to sales tax.

Fifth Schedule is given hereunder:

| Sr. # | Description |

| 1. | (i) Supply, repair or maintenance of any ship which is neither;

(a) a ship of gross tonnage of less than 15 LDT; nor (b) a ship designed or adapted for use for recreation or pleasure. (ii) Supply, repair or maintenance of any aircraft which is neither (a) an aircraft of weight-less than 8000 kilograms; nor (b) an aircraft designed or adapted for use for recreation or pleasure. (iii) Supply of spare parts and equipment for ships and aircraft falling under (i) and (ii) above. (iv) Supply of equipment and machinery for pilot age, salvage or towage services. (v) Supply of equipment and machinery for air navigation services. (vi) Supply of equipment and machinery for other services provided for the handling of ships or aircraft in a port or Customs Airport. |

| 2. | Supply to diplomats, diplomatic missions, privileged persons and privileged organizations which are covered under various Acts, Orders, Rules, Regulations and Agreements passed by the Parliament or issued or agreed by the Government of Pakistan. |

| 3. | Supplies to duty free shops, provided that in case of clearance from duty free shops against various baggage rules issued under the Customs Act, 1969, (IV of 1969), the supplies from duty free shops shall be treated as import for the purpose of levy of sales

tax. |

| 4. | Supplies of raw materials, components and goods for further manufacture of goods in the Export Processing Zone. |

| 5. |

Supplies of such locally manufactured plant and machinery to petroleum and gas sector Exploration and Production companies, their contractors and sub-contractors as may be specified by the Federal Government, by notification in the official Gazette, subject to such conditions and restrictions as may be specified in such notification. |

| 6. | Supplies of locally manufactured plant and machinery of the

following specifications, to manufacturers in the Export processing zone, subject to the conditions, restriction and procedure given below, namely:- (i) Plant and machinery, operated by power of any description, as is used for the manufacture or production of goods by that manufacture, (ii) Apparatus, appliances and equipments specifically meant or adapted for use in conjunction with the machinery specified in clause (i) ; (iii) Mechanical and electrical control and transmission gear, meant or adopted for use in conjunction with machinery specified in clause (i) ; and (iv) Parts of machinery as specified I clauses (i), (ii) and (iii) identifiable for use in or with such machinery. Conditions, restrictions and procedures:- (a) The supplier of the machinery is registered under the Act: (b) Proper bill of export is filed showing registration number; (c) The purchaser of the machinery is an established manufacturer located in the Export processing zone and holds a certificate from the Export processing zone and holds a certificate from the Export processing zone Authority to that effect; (d) The purchaser submits and indemnity bond in proper form to the satisfaction of the concerned commissioner inland Revenue that the machinery shall, without prior permission from the said commissioner, not be sold, transferred or otherwise moved out of the Export processing zone before a period of five years from the date of entry into the Zone; (e) If the machinery in brought to tariff area of Pakistan, sales tax shall be charged on the value assessed on the bill of entry; and (f) Breach of any of the conditions specified herein shall attract legal action under the relevant provisions of the Act, besides recovery of the amount of sales tax along with default surcharge and penalties involved.”; (g) Against serial number 9, in column (2), the word “who makes local supplies of both taxable and exempt goods” shall be omitted; (h) Against serial number 12, in column (2), in clause (ix), the words “including flavored milk” and the word and figure “and 0402.9900” shall be omitted; and thereafter clauses (x) to (xvi) shall be omitted; |

| 7. | Supplies made To exporters under the Duty and Tax Remission Rules, 2001 subject to the observance of procedures, restrictions and conditions prescribed therein. |

| 8. | Imports or supplies made to Gawadar Special Economic Zone, excluding vehicles falling under heading 87.02 of the Pakistan Customs Tariff, subject to such conditions, limitations and restrictions as the Board may impose. |

| 9. | Petroleum Crude Oil. |

| 10. |

Goods exempted under section 13, if exported by a manufacturer who makes local supplies of both taxable and exempt goods. |