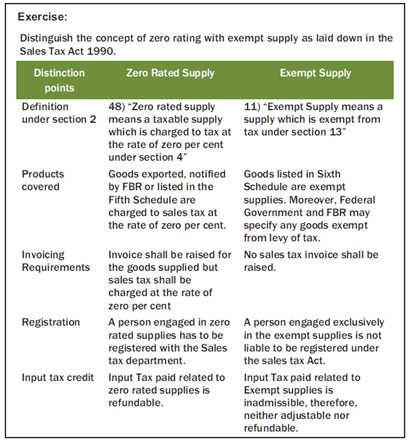

GOODS EXEMPT FROM SALES TAX (SEC-13)

- Supply of goods or import of goods specified in the Sixth Schedule shall, subject to such conditions as may be specified by the Federal Government, be exempt from tax under Sales Tax Act. The provisions of section 13 shall apply notwithstanding anything contained in section 3.

- The Federal Government may, pursuant to the approval of the Economic Coordination Committee of Cabinet exempt any taxable supplies made or import or supply of any goods or class of goods from the whole or any part of the tax chargeable under the Sales Tax Act. This exemption shall be notified in the official Gazette and shall be subject to such conditions and limitations as specified in the notification.

- Exemption from tax chargeable under above second paragraph above may be allowed from any previous date specified in the notification issued or order made.

- The Federal Government shall place before the National Assembly all exemptions related notifications issued during the financial year.

- Any notification issued above, if not earlier recommended stand rescinded on the expiry of financial year in which it has issued.