Scope of Income

INCOME TAX ORDINANCE 2001

Chapter 01

Lecture 03

Topic – Scope of Income

Click here for Complete Video Lecture Scope of Income .

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Includes:

01- Scope of Income with respect to taxability under the provisions of Income Tax Laws enacted in Pakistan i.e. Income Tax Ordinance 2001.

02- Taxability of resident person and non-resident person

03- Geographical sources of Incomeand their taxability

04-Taxability of returning expetriate

05- Foreign source salary

06- Exeptions for foreign source salary

07- Understanding the Tax treatment of person with respect to Tax Year required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Lecture by:

Tax year as defined in ITO 2001

INCOME TAX ORDINANCE 2001

Relevant Sections – 74

Chapter 01

Lecture 01

Topic – Tax Year

Click here for Complete Video Lecture Tax Year .

Tax year (Sec-74)

There are three kinds of tax years as stipulated in Section 74 of the Income Tax Ordinance, 2001:

⇒ Normal tax year

⇒ Special tax year

⇒ Transitional tax year

Normal tax year

Normal tax year is a period of twelve months ending on the 30th day of June and is denoted by the calendar year in which the said date falls.

Special tax year

Where a person’s income year is different from the normal tax year, or where, by an order, a person has been allowed by the Commissioner to use a twelve months’ period different from normal tax year, such income year or such period shall be that person’s special tax year and shall be denoted by the calendar year relevant to normal tax year in which the closing date of the special tax year falls.

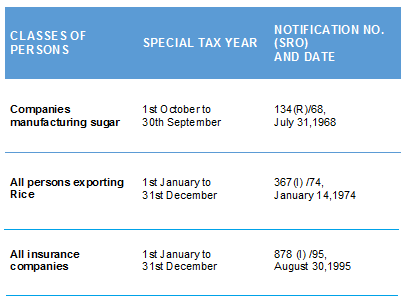

The Board has authority to prescribe any special tax year in respect of any particular class of taxpayer. For example in respect of certain classes of assesses following special tax years are specified by the Board.

Here are the SROs

Change in Tax Year:

In addition to above, a taxpayer may get permission to adopt special income year subject to fulfilment of following conditions laid down in section 74 ibid:

A person may apply to the Commissioner for change of tax year from normal tax year to special tax year or from special tax year to normal tax year and the same can be granted subject to any conditions that may be imposed by the Commissioner.

A change of tax year from normal to special or vice versa, granted by the Commissioner is subject to withdrawal if in his opinion it is no longer feasible but not unless the person has been provided an opportunity of being heard.

An order of the Commissioner for change of tax year shall take effect from such date, being the first day of the special tax year or the normal tax year, as the case may be, as may be specified in the order.

A person dissatisfied with the order may file a review application with the Board against the decision of the Commissioner at the time of granting permission for a special tax year or withdrawal of the same and the decision by the Board on such application shall be final.

Transitional tax year

Where the tax year of a person changes as a result of an order by the Commissioner of Income tax either from the normal tax year to special tax year or vice versa, the period between the end of the last tax year prior to change and the date on which the changed tax year commences shall be treated as a ‘transitional tax year’.

Example

The normal tax year of ABC Limited was the period from 01 July 2015 to 30 June 2016. On an application by ABC Limited, Commissioner granted approval to adopt special tax year of 30 September each year. The period from 01 July 2016 to 30 September 2016 will be treated as transitional tax year.

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Video Lecture by:

INCOME TAX – DEFINITIONS

INCOME TAX ORDINANCE 2001

Basic Concepts

Lecture 01

Topic – Income Tax Definitions

Click the link for Complete Video Lecture on ” IT – Definitions “.

Includes:

01- Basic concepts of Definitions in Income Tax Laws applicable in Pakistan i.e. Income Tax Ordinance 2001.

02- Types of Definitions

03- Basic definitions required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Lecture by well known Chartered Accountant honorable Mr. Khalid Petiwala, FCA.

INCOME TAX – CAPITAL RECEIPTS

INCOME TAX ORDINANCE 2001

Basic Concepts

Lecture 02

Topic – Capital Receipts

Click the link for Complete Video Lecture by re-known Chartered Accountant honorable Mr. Khalid Petiwala, FCA on “Basic Concepts 01 – Capital Receipts “.

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Includes:

01- Basic concepts of Receipts under the provisions of Income Tax Laws applicable in Pakistan i.e. Income Tax Ordinance 2001.

02- Types of Receipts

03- Understanding of Capital Receipts required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Residential Status under Income Tax Laws

INCOME TAX ORDINANCE 2001

Chapter 01

Lecture 02

Topic – Residential Status

Click here for Complete Video Lecture Chapter 01.02 – Residential Status .

Examinations covered here :

ICAP CAF 06 – Principals of Taxation & ICAP CFAP 05 – Advance Taxation

Includes:

01- Basic concepts of Residence in Income Tax Laws applicable in Pakistan i.e. Income Tax Ordinance 2001.

02- Types of Persons.

03- Understanding of Residential Status of a person.

04- Tax treatment of person with respect to residentail status required for ICAP student preparing for the CA-Inter (now CAF stage) examination of CAF 06 – Principals of Taxation and CA-Final (now CFAP stage) examination of CFAP 05 – Advance Taxation.

Lecture by:

Chartered Accountancy in Pakistan

See all you want in the link below:

======================================================================================

ICAP_Catalogue_2014.pdf

==========================================================================

You need further detail and queries contact below: